By Christopher B. Tobe, CFA, CAIA

Pension Risk Transfer Annuities (PRT’s) replace a solid diversified defined benefit plan with federal (PBGC) insurance, with a high single entity risk annuity with higher risks and weak state regulation.

Pension Risk Transfers (PRT’s) shift the risk off the plan sponsor onto the backs of the participants. This allows plan sponsors to lower costs and insurance companies billions at the expense of participants and retirees.

It appears that large pension plans have been in a hurry to close Pension Risk Transfer deals, before their victims the participants wake up and see the raw deal they are getting.[i] Regulators, to my knowledge, have never tested this risk with actuarial analysis. Under industry pressure they came up after the Executive Life defaults IB95-1 a weak rule to pick the “safest available annuity”. I think the premise of a least risky annuity would is like a less risky plane crash.

However, plan sponsors are not off the hook, due to the ability of plaintiffs to recover these losses through litigation. The Burden of proof is on plan sponsors that their plan PRT Annuity contract has low enough risk to be exempted from being a Prohibited Transaction and is at a reasonable cost.

Fiduciary Breaches of PRT Annuity Contracts

PRT Annuity Contracts are a Fiduciary Breach for 4 basic reasons.[ii]

- Single Entity Credit Risk[iii]

- Single Entity Liquidity Risk in illiquid investments [iv]

- Hidden fees spread and expenses [v]

- Structure -weak cherry-picked state regulated contracts, not securities and useless reserves [vi]

These breaches make it impossible for most annuity products to qualify for exemptions to Prohibited Transactions.[vii]

The Federal Reserve in 1992 exposed the weak state regulatory and reserve claims of Fixed annuities in retirement plans.[viii] In 2008 Federal Reserve Chairman Ben Bernanke said about these annuity products “workers whose 401(k) plans had purchased $40 billion of insurance from AIG against the risk that their stable-value funds would decline in value would have seen that insurance disappear.”[ix] In the major stable value annuity source book, single annuity like PRTs are shown to have 10 times the risk of a diversified fixed portfolio. [x]

.

The Burden of proof is on plan sponsors that they have documented due diligence on these risk issues and that their PRT Annuity contract is exempted from being a Prohibited Transactions. [xi]

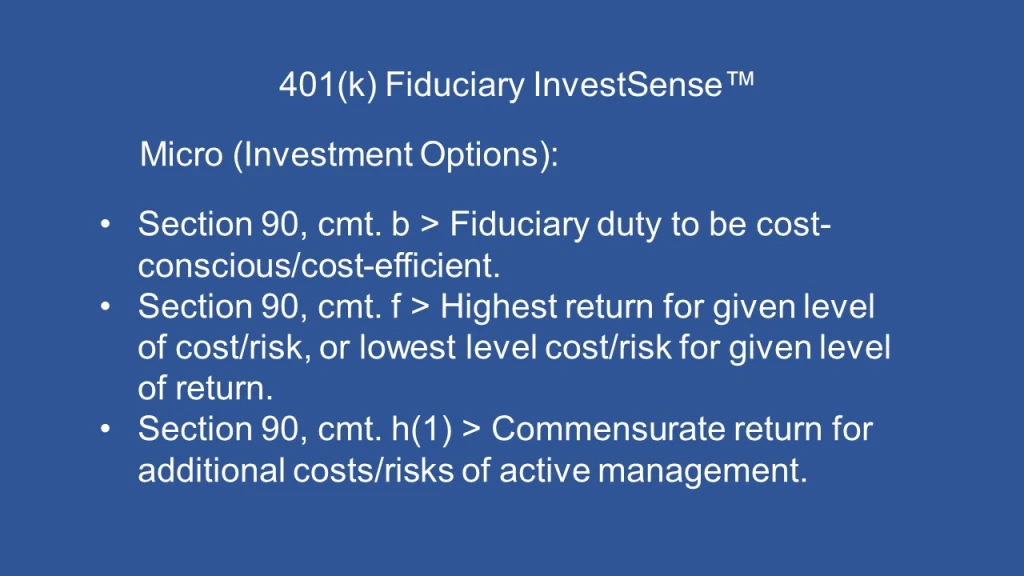

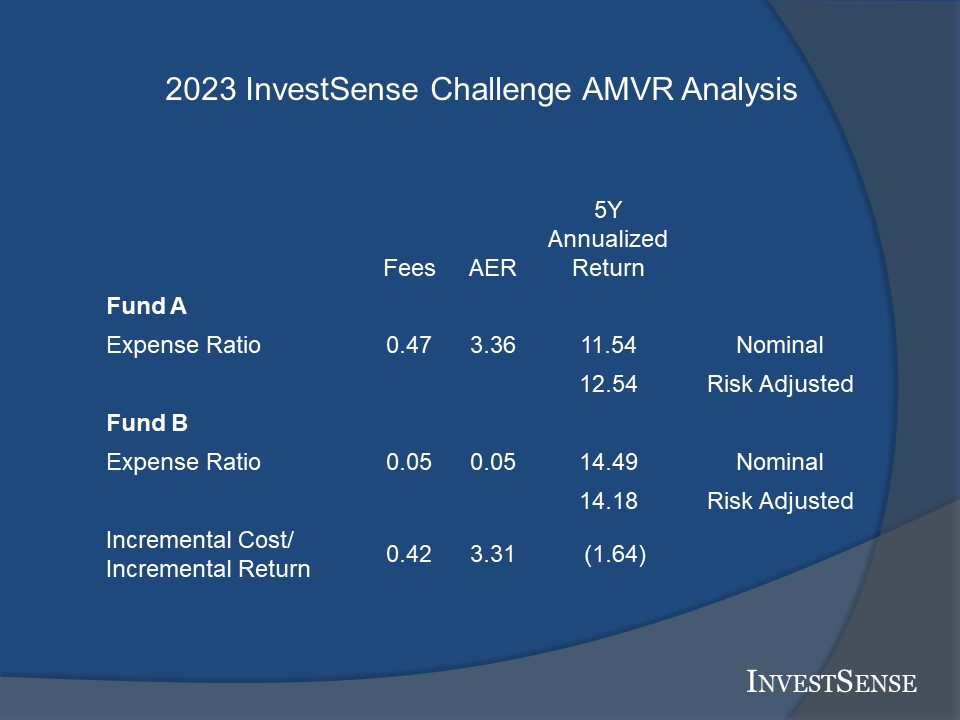

Fiduciary Transparency Conflicts Tests – Loyalty Excessive Compensation

As a plan sponsor you should put all products through these fiduciary transparency tests, I contend that annuities almost always flunk this basic level of care.

Annuities avoid transparency with poor state regulated structures which allow them to hide excessive risks and fees. Annuity providers fight hard to avoid any Federal Regulations usually favoring state regulation in their home states where they are major employers and have higher political influence. Even industry insiders admit hidden fees are problematic to adopting annuities.[xii]

After the 2008 financial crisis several Insurers were forced into Federal Regulation under SIFI (too big to fail) they did everything to get out of the higher transparency and higher capital requirements.[xiii]

Annuity contracts have been characterized by retirement group NAGDCA as having serious fiduciary issues. “Due to the fact that the plan sponsor does not own the underlying investments, the portfolio holdings, performance, risk, and management fees are generally not disclosed.

It also makes it nearly impossible for plan sponsors to know the fees (which can be increased without disclosure) paid by participants in these funds—a critical component of a fiduciary’s responsibility “ [xiv]

Plans need to put their Loyalty to plan participants first which is their fiduciary duty. They do not have loyalty to vendors such as money managers and annuity providers.

Annuities have an Inherent conflict because investment dollars leave the ownership of the plan and participants and become part of the balance sheet of the insurance company.

Annuity contracts are designed to avoid all fiduciary obligation with no loyalty to participants. Most annuity providers refuse to sign a “Fiduciary Acknowledgement Disclosure.”

DOL official Khawar said. “” Under the National Association of Insurance Commissioners’ model rule, for example, “compensation is not considered a conflict of interest,” [xv]

Annuities have a total lack of disclosure of profits, fees and compensation. They have secret kickback commissions. How can a plan claim any of the compensation annuity provider receives is reasonable if it is secret and not disclosed.

Current Cases – Worst of Worst Athene-Apollo

PRTs have been operating under a weak DOL rule to pick the “safest available annuity”. Over decades traditional insurers have made millions. While default risk is present with traditional insurers, they do want to sustain the business long-term and avoid default. When Private Equity players got involved, with their short-term mentality, they are set to strip billions in profits, not afraid to bankrupt companies and “kill the Golden Goose” for the traditional part of the business.

With these significant differences in risks and profit for the private equity insurers, it has created measurable damages that has jump started litigation.

From Piercy v. AT&T filed on 3/11/24 says, AT&T turned its back on its retired workers, choosing to put the pensions of almost 100,000 AT&T retirees in peril, to secure AT&T an enormous profit. AT&T stood to gain—and did gain—more than $360 million in profit from this scheme The only losers in the transaction were AT&T’s retirees, who face the danger—now and in the future—that their lifelong pensions will go unpaid while they have lost all the protections of federal law.

As pointed out above the standard PRT is at least 10 times that of a diversified portfolio, but that an even riskier single entity credit risk like private equity backed Athene could have 20 times the risk. [xvi]

Most of the current PRT cases are against Apollo owned Athene. Apollo is infamous with over

684 regulatory violations. [xvii] Fines range from the DOJ $210 million fine for accounting fraud, to $53 Million by the SEC for misleading investors on fees. [xviii] Other claims against Apollo are around investor protection violations, consumer protection violations, and the false claims act.

In early 2021 Apollo founder & CEO Leon Black resigned after paying $158 million in “tax advice” to Jeffrey Epstein.[xix] In 2015 Apollo was involved in a massive pay to play scheme involving a trustee and CEO of CALPERS the US largest public pension. The CALPERS CEO Buenrostro was sent to prison and the trustee Villalobos committed suicide before serving his term.[xx]

Conclusion

In a submitted academic paper on Annuity risks it touts the risks of PRT’s. It states the “Emperor has no Clothes” as the life insurance industry has poured billions of dollars into advertising, lobbying, commissions & trade articles with misinformation on annuities with everyone afraid to call out the obvious.[xxi]

The ultimate responsibility and the burden of proof goes on to the plan sponsor to prove this annuity purchase was for the benefit of participants. Those who have pulled the trigger on these questionable annuity deals will probably face litigation.

[i] https://www.chicagofed.org/publications/economic-perspectives/2024/5 https://www.chicagofed.org/publications/chicago-fed-letter/2024/494

[ii] https://commonsense401kproject.com/2022/05/11/annuities-are-a-fiduciary-breach/ https://commonsense401kproject.com/2024/11/29/crypto-private-equity-annuity-contracts-are-impossible-to-benchmark/

[iii] https://commonsense401kproject.com/2024/03/26/just-how-safe-are-safe-annuity-retirement-products-new-paper-shows-annuity-risks-are-too-high-for-any-fiduciary/ https://www.thinkadvisor.com/2024/11/20/yes-life-and-annuity-issuers-can-suddenly-collapse-treasury-risk-tracker-warns/

[iv] https://www.chicagofed.org/publications/economic-perspectives/2024/5 https://www.chicagofed.org/publications/chicago-fed-letter/2024/494

[v] https://www.bloomberg.com/news/articles/2013-03-06/prudential-says-annuity-fees-would-make-bankers-dance?embedded-checkout=true TIAA https://www.nbcnews.com/investigations/tiaa-pushes-costly-retirement-products-cover-losses-whistleblower-rcna161198

[vi] Federal Reserve Bank of Minneapolis Summer 1992 Todd, Wallace SPDA’s and GIC’s http://www.minneapolisfed.org/research/QR/QR1631.pdf https://www.chicagofed.org/publications/economic-perspectives/1993/13sepoct1993-part2-brewer

[vii] https://commonsense401kproject.com/2024/10/10/annuities-exposed-as-prohibited-transaction-in-401k-plans/

[viii] Federal Reserve Bank of Minneapolis Summer 1992 Todd, Wallace SPDA’s and GIC’s http://www.minneapolisfed.org/research/QR/QR1631.pdf

[ix] http://www.federalreserve.gov/newsevents/testimony/bernanke20090324a.htm

[x] The Handbook of Stable Value Investments 1st Edition by Frank J. Fabozzi 1998 Jacquelin Griffin Evaluating Wrap Provider Credit Risk in Synthetic GICs pg. 272 https://www.amazon.com/Handbook-Stable-Value-Investments/dp/1883249422

[xi] https://commonsense401kproject.com/2024/11/19/burden-of-proof-is-on-plan-sponsors-hoping-to-qualifyfor-annuity-prohibited-transactions-exemption/

[xii] https://riabiz.com/a/2024/5/11/fidelity-voya-and-boa-smooth-blackrocks-launch-of-guaranteed-paycheck-etfs-but-401k-plan-participants-may-yet-balk-at-high-unseeable-fees-and-intangibility-of-benefits

[xiii] https://www.stanfordlawreview.org/online/the-last-sifi-the-unwise-and-illegal-deregulation-of-prudential-financial/

[xiv] http://www.nagdca.org/documents/StableValueFunds.pdf_ The National Association of Government Defined Contribution Administrators, Inc. (NAGDCA) September 2010.

[xv] https://www.thinkadvisor.com/2024/10/07/top-dol-official-sees-a-nonsensical-reality-at-heart-of-fiduciary-fight/

[xvi] The Handbook of Stable Value Investments 1st Edition by Frank J. Fabozzi 1998 Jacquelin Griffin Evaluating Wrap Provider Credit Risk in Synthetic GICs pg. 272 https://www.amazon.com/Handbook-Stable-Value-Investments/dp/1883249422

[xvii] https://violationtracker.goodjobsfirst.org/?company=Apollo

[xviii] https://www.ai-cio.com/news/apollo-fined-53-million-over-fees/

[xix] https://www.nytimes.com/2021/01/26/business/jeffrey-epstein-leon-black-apollo.html

[xx] https://www.latimes.com/business/la-fi-villalobos-suicide-20150115-story.html

[xxi] Lambert, Thomas E. and Tobe, Christopher B., “Safe” Annuity Retirement Products and a Possible US Retirement Crisis (March 18, 2024). Available at SSRN: https://ssrn.com/abstract=4763269