AI Infrastructure, Epstein Lies, and the Growing Fiduciary Risk

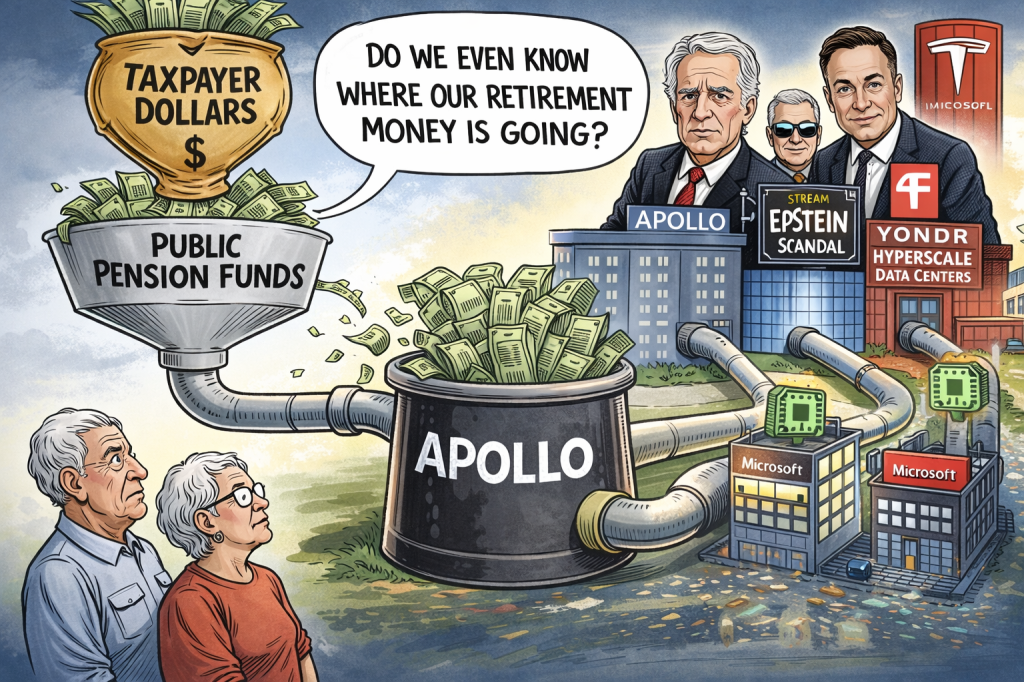

Public pension funds across the United States are quietly helping finance one of the largest artificial-intelligence infrastructure buildouts in the world. But they are doing it through a firm whose credibility with investors should already have been exhausted.

That firm is Apollo Global Management.

Over the past decade, Apollo has built a massive private-equity and private-credit empire fueled by public pension money from teachers, firefighters, and state workers across the country. Now that same capital is being deployed into the booming artificial-intelligence infrastructure industry—particularly hyperscale data centers and GPU compute facilities required for AI systems.

What pension trustees may not fully appreciate is that this new AI infrastructure empire is being built by a firm whose leadership has repeatedly misled investors and the public about its relationship with Jeffrey Epstein, and whose business model increasingly relies on opaque private credit structures and complex financial engineering that reduce transparency for the very public funds financing it.

The problem is not merely reputational.

It is fiduciary.

The New Apollo: From Buyouts to AI Infrastructure

Apollo is no longer just a private-equity buyout firm. It has quietly become one of the largest financiers of digital infrastructure in the world.

Through a combination of private-equity funds, infrastructure vehicles, and private-credit structures, Apollo has built a portfolio of hyperscale data-center developers and AI infrastructure platforms that now stretch across the United States and Europe.

Among the most significant are Stream Data Centers, a U.S. hyperscale data-center developer whose majority stake was acquired by Apollo funds to accelerate a development pipeline exceeding four gigawatts of computing capacity. These campuses are being built in markets such as Dallas, Chicago, Phoenix, and other major cloud corridors.

Apollo infrastructure funds have also invested in Yondr Group, a global developer of hyperscale data-center campuses supporting the rapid expansion of artificial-intelligence computing infrastructure.

In Europe, Apollo infrastructure vehicles acquired a pan-European colocation platform carved out of STACK Infrastructure, creating a network of highly interconnected data-center facilities in cities including Stockholm, Oslo, Copenhagen, Milan, and Geneva.

And in perhaps the clearest example of Apollo’s growing role in AI infrastructure finance, Apollo-managed funds recently led a $3.5 billion financing package supporting a $5.4 billion acquisition and lease of GPU compute infrastructure—including advanced NVIDIA chips—used by a subsidiary of Elon Musk’s artificial-intelligence company xAI.

In other words, Apollo has positioned itself as a central financier of the physical infrastructure behind the AI boom.

But the money for these investments does not originate with Apollo.

It originates with public pensions.

The Pension Money Pipeline

Public pensions do not typically invest directly in data-center campuses or AI hardware. Instead they commit capital to Apollo funds, which pool those commitments and deploy the capital into infrastructure platforms, credit vehicles, and acquisitions.

The capital chain looks like this:

Public pensions → Apollo funds → Apollo infrastructure platforms → AI data centers and compute infrastructure.

The list of pension systems providing capital upstream of Apollo’s infrastructure push is extensive.

Major systems with documented commitments include the California State Teachers’ Retirement System (CalSTRS), the California Public Employees’ Retirement System (CalPERS), the Indiana Public Retirement System, the Connecticut Retirement Plans and Trust Funds, and the State Teachers Retirement System of Ohio.

CalSTRS alone has committed hundreds of millions of dollars across multiple Apollo private-equity funds and hybrid-value vehicles. CalPERS has also committed hundreds of millions to Apollo partnerships.

Ohio’s teacher pension system has been reported to have roughly $600 million invested in Apollo private-equity partnerships.

Across the country, other systems—including pensions in Pennsylvania, Oregon, Washington, Colorado, Arizona, Florida, Texas, North Carolina, Illinois, Iowa, Kansas, Rhode Island, and Massachusetts—have also committed capital to Apollo vehicles.

Because these investments are made as limited-partner commitments to private-equity funds, pension trustees often cannot see exactly where their capital ultimately flows. But economically the pipeline is clear.

Public pensions provide the capital base.

Apollo deploys it.

And increasingly it is being deployed into AI infrastructure.

The scale of this capital flow is enormous.

The Epstein Problem That Never Went Away

Apollo’s rapid expansion into infrastructure is occurring while the firm still struggles with the shadow of its founder’s relationship with Jeffrey Epstein.

Apollo co-founder Leon Black paid Epstein more than $150 million for purported tax and estate planning services. Investigations later revealed that Epstein had also helped introduce Black to a network of wealthy investors.

For years, Apollo attempted to portray the relationship as a purely professional advisory arrangement.

But multiple investigations, documents, and witness testimony have painted a far more troubling picture of the firm’s culture and leadership.

More recently, Apollo CEO Marc Rowan has repeatedly attempted to minimize the firm’s connections to Epstein and characterize the scandal as a closed chapter.

Yet new disclosures and reporting continue to contradict that narrative.

For public pension trustees, the issue is not merely reputational embarrassment. It raises a fundamental fiduciary question.

Why are public pension funds still allocating billions of dollars to a firm whose leadership misled investors and the public about one of the most notorious financial scandals in modern history?

The AI Gold Rush—and the Transparency Problem

Apollo’s push into artificial-intelligence infrastructure is also occurring in an investment environment that is becoming increasingly opaque.

Unlike traditional infrastructure investments such as toll roads or airports, AI data centers often involve complicated financing structures combining private equity, infrastructure funds, structured credit, and long-term leasing arrangements tied to cloud and AI companies.

These structures can obscure the true economic exposure and risk borne by investors.

Public pension trustees may believe they are investing in diversified private-equity funds. In reality, portions of their capital may be concentrated in highly leveraged infrastructure bets tied to the volatile AI technology cycle.

In addition, Apollo has become one of the largest players in private credit, a market where assets are rarely marked to market and valuations can remain artificially stable even as underlying credit risk deteriorates.

That lack of transparency creates a dangerous combination:

• opaque asset valuations

• illiquid infrastructure assets

• complex credit structures

• and limited disclosure to public pension investors.

When these risks are layered onto the governance concerns surrounding Apollo’s leadership history, the fiduciary implications become increasingly difficult to ignore.

The Fiduciary Case for Divestment

Public pension trustees have a legal obligation to act solely in the interests of plan beneficiaries.

That duty includes evaluating not only financial risk but also governance risk, reputational risk, and the credibility of investment managers entrusted with billions of dollars of retirement savings.

Apollo now presents all of those risks simultaneously.

It is a firm whose founder’s relationship with Jeffrey Epstein became one of the largest governance scandals in modern finance.

It is a firm that has repeatedly attempted to minimize or obscure that relationship.

And it is a firm whose current growth strategy depends heavily on opaque private-credit structures and infrastructure investments that public pension trustees may struggle to fully evaluate.

The AI infrastructure boom may ultimately prove profitable.

But fiduciary duty does not require pensions to finance it through a manager whose credibility has been compromised and whose investment structures reduce transparency.

Public pension systems have divested from firms in the past over far less serious concerns.

They have divested over political controversies, environmental risks, and governance failures.

If fiduciary standards mean anything, they should apply equally to Apollo.

The Question Trustees Must Now Ask

Across the United States, teachers and public workers are unknowingly helping finance a global network of artificial-intelligence data centers through investments in Apollo funds.

Most beneficiaries likely have no idea that their retirement savings are being routed through a firm tied to one of the largest financial scandals of the past decade.

Nor do they know that the same capital is helping build the physical infrastructure behind the AI boom.

Public pension trustees must now confront a simple question.

Should the retirement savings of millions of teachers and public employees continue to finance the expansion of a firm whose credibility with investors was shattered by the Epstein scandal?

Or is it time for pensions to finally do what they should have done years ago:

Divest from Apollo.