Liability-driven investing is a common concept in connection with defined benefit plans. I first heard the term used in a article by Marcia Wagner of the Wagner Group. Liability-driven investing refers to the selection of investments that are best designed to help the plan secure the returns needed by the plan to fulfill their obligations under the terms of the plan.

It has always struck me that the liability-driven concept is equally applicable to designing defined contribution plans such as 401(k) and 403(b) plans. Better yet, by factoring in fiduciary risk management principles, defined contribution plans can create the best of both worlds, win-win plans that provide prudent investment options while minimizing or eliminating fiduciary risk.

Plan sponsors often unnecessarily expose themselves to fiduciary liability simply because they do not truly understand what their duties are under ERISA. One’s fiduciary duties under ERISA can be addressed by asking two simple questions.

1. Does Section 404(a) of ERISA explicity require that a plan offer the category of investments under consideration?

2. If so, could/would inclusion of the investment under consideeration result in uunecessary liability exposure for the plan?

As for the first question, Section 404(a)1 of ERISA does not explicity require that any specific category of investment be offered within a plan. As SCOTUS stated in the Hughes decision2, the only requirement under Section 404(a) is that each investment option offered within a plan be prudent under fiduciary law. Furthermore, as SCOTUS stated in its Tibble decision3, the Restatement of Trusts (Restatement) is a valuable resource in addressing and resolving fiduciary issues.

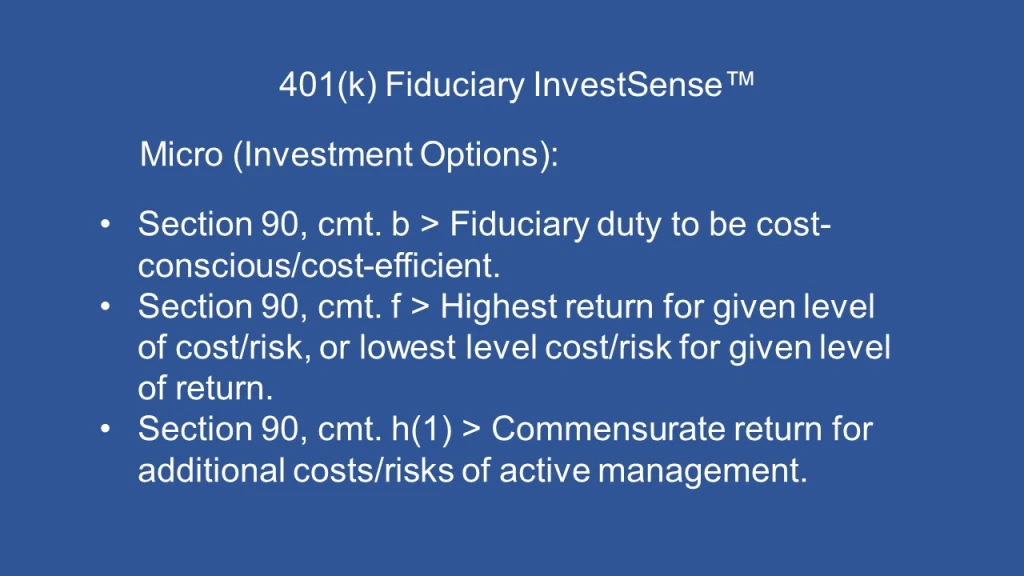

As for the second question, Section 90 of the Restatement, more commonly known as the “Prudent Investor Rule,” offers three fundamental guidelines addressing the importance of cost-consciousness/cost-efficiency of a plan’s investment options:

The last bullet point highlights a key aspect of 401(k)/403(b) fiduciary prudence and cost-efficiency – commensurate return for the additional costs and risks assumed by the plan participant. In terms of actively managed mutual funds, research has consistently and overwhelmingly shown that the majority of actively managed mutual funds are cost-inefficient:

- 99 % of actively managed funds do not beat their index fund alternatives over the long term net of fees.4

- Increasing numbers of clients will realize that in toe-to-toe competition versus near-equal competitiors, most active managers will not and cannot recover the costs and fees they charge.5

- [T]here is strong evidence that the vast majority of active managers are uable to produce excess returns that cover their costs.6

- [T]he investment costs of expense ratios, transaction costs and load fees all have a direct, negative impact on performance….[The study’s findings] suggest that mutual funds, on average, do not recoup their investment costs through higher returns.7

The Active Management Value RatioTM (AMVR)

Several years ago I created a simple metric, the AMVR. The AMVR is based on the research of investment icons such as Nobel laureate Dr. William F. Sharpe, Charles D. Ellis, and Burton L. Malkiel. The AMVR allows plan sponsors, trustees, and other investment fiduciaries to quickly determine whether an actively managed fund is cost-efficient relative to a comparable index fund. The AMVR allows the user to assess the cost-efficiency of an actively managed fund from several perspecitives.

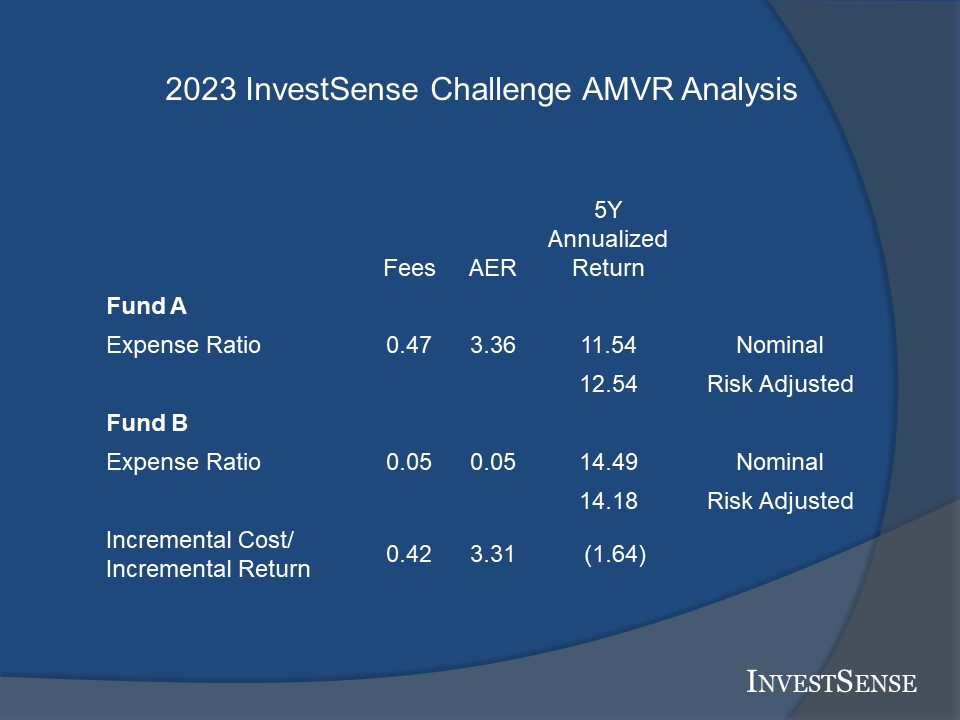

The slide below shows an AMVR analysis comparing the retirement shares of a popular actively managed fund, the Fidelity Contrafund Fund (FCNKX), and the retirement shares of Vanguard’s Large Cap Growth Index Fund (VIGAX). The analysis compares the two funds over a recent 5-year time period. When InvestSense provides forensic services, we provide both a five-year and ten-year analysis to determine the consistency of any cost-efficiency/cost-inefficiency trend.

An AMVR analysis can provide any amount of detail the user desires. On a basic level, the fact that the actively managed fund failed to outperform the comparable index fund benchmark immediately indicates that the actively managed fund is imprudent relative to the Vanguard fund.

Add to that the fact that the actively managed fund imposed an incremental, or additional, cost of 42 basis points without providing any corresponding benefit for the investor. A basis point is a term commonly used in the investment world. A basis point equals 1/100th of one percent (0.01). 100 basis points equals 1 percent.

So the bottom line is that the actively managed fund underperformed the benchmark Vanguard fund and imposed an additional charge without providing a commensurate return for the extra charge. A fiduciary’s actions that result in wasting a client’s or a beneficiary’s money is never prudent.8

If we treat the actively managed fund’s underpreformance as an opportunity cost, and combine that cost with the excess fee, we get a total cost of 2.06. The Department of Labor and the General Accountability Office have determined that over a twenty year time period, each additional 1 percent in costs reduces an investor’s end-return by approximately 17 percent.9 So, in our example, we could estimate that the combined costs would reduce an investor’s end-return by approximately 34 percent. This is not an example of effective wealth management.

The AMVR is calculated by dividing an actively managed fund’s incremental correlation-adjusted costs by the fund’s incremental risk-adjusted return. The goal is an AMVR score greater than zero, but equalt to or less than one, which indicates that costs did not exceed return. While the user can simply use the actively managed fund’s incremental cost and incremental returns based on the two funds’ nominal, or publicly reported, numbers, the value of such an AMVR calculation is very questionable.

A common saying in the investment industry is that return is a function of risk. In other words, as comment h(2) of Section 90 of the Restatement states, investors have a right to receive a return that compensates them for any additional costs and risks they assumed in investing in the investment. The Department of Labor has taken a similar stand in two interpretive bulletins.10 That is why a proper forensic analysis always uses a fund’s risk-adjusted returns.

While the concept of correlation-adjusted returns is relatively new, it arguably provides a better analysis of the alleged value-added benefits, if any, of active management. The basis premise behind correlation-adjusted costs is that passive management often provides all or most of the same return provided by a comparable actively managed fund. As a result, the argument can be made that the actively managed fund was imprudent since the same return could have been achieved by passive management alone, without the wasted excess costs of the actively managed fund.

Professor Ross Miller created a metric called the Active Expense Ratio (AER).11 Miller explained that actively managed funds often combine the costs of passive and active management in such a way that it is hard for investors to determine if they are receiving a commensurate return. The AER provides a method of separating the cost of active management from the costs of passive management.

The AER also calculates the implicit amount of active management provided by an actively managed fund, a term that Miller refers to as the actively managed fund’s “active weight.” Miller then divides the active fund’s incemental costs by the fund’s active weight to calculate the actively managed fund’s AER.

Miller found that an actively managed fund’s AER is often 400-500 percent higher than the actively managed fund’s stated expense ratio. In the AMVR example shown above, dividing the actively managed fund’s incremental correlation-adjusted costs by the fund’s active weight would result in an implicit expense ration approximately 700 percent higher than the fund’s publicly stated incremental cost (3.31 vs. 0.42). Based on the AER, these significantly higher costs would be incurred to receive just 12.5 percent of active management.

Using the same 1:17 percent analysis for each additional 1 percent in costs/fees, using the AER metric and the active fund’s underperformance would result in a projected loss of approximately 84 percent over twenty years. So much for “retirement readiness.”

Additional information on the AMVR can be found at my “The Prudent Investment Fiduciary Rules” blog and searching under “Active Management Value Ratio.”

Fiduciary Risk Management and Annuities

I have written numerous posts about annuities on both my “The Prudent Investment Fiduciary Rules” blog and my “CommonSense InvestSense” blog. Fortunately, the inherent fiduciary liability issues can be addressed by using the same two question fiduciary risk management approach that was mentioned earlier, with the answer to both questions being “yes.” Therefore, a liability-designed 401(k)/403(b) plan will totally avoid the inclusion of annuities, in any form, within the plan.

As a former securities compliance director, I am very familiar with the questionable marketing techniques used by some annuity companies, including the ongoing refusal to provide full transparency with regard to spreads and other financial information. Both ERISA and Department of Labor interpretive bulletions have stressed the importance of providing material information to plan sponsors and plan participants so that they can make informed decisions about including annuities within a plan and about whether to invest in annuities.

The two blogs provide analyses of various types of annuities, especially variable annuities and fixed indexed annuities. My basic advice to my fiduciary risk management clients is simple – “if you don’t have to go there…don’t!”

Annuities are complex and confusing investments, with numerous potential fiduciary liability “traps.” Annuity advocates often try to further confuse and intimidate plan sponsors by engaging in technical details. I strongly recommend adopting my response – stop them before they begin and simply explain that ERISA does not require that pension plans offer annuities within a plan. Therefore, from a fiduciary risk management standpoint, there is no reason to offer any type of annuity within the plan.

Going Forward

Three fiduciary risk management questions that I often ask both myself and my fiduciary clients:

- Why is it that cost/benefit analysis is often used by businesses to determine the cost-efficiency of a proposed project, but yet cost-efficiency is rarely used by plan sponsors and other investment fiduciaries to determine the cost-efficiency of investments being considered by a pension plan or other fiduciary entity?

- Why is it that plan sponsors will blindly accept conflicted advice from “advisers” without requiring that the adviser document the prudence of their recommendations througn prudence/breakeven analyses such as the AMVR or an annuity breakeven analysis?

- Why do plan sponsors insist on making it so unnecessarily difficult and costly by refusing to see the simplicity, praticality, and prudence of the federal government’s Thrift Saving Plan?

The three bullet points remind me of one of my favorite quotes – “there are none so blind, as they who will not see.” I am not sure to whom it should be properly atttributed. The two most cited sources are the Bible and Jonathan Swift.

The point of this post is to emphasize that ERISA compliance is not that difficult to accomplish if a plan talks with the right people and approaches the compliance issues right from the start, when actually designing or re-designing the plan . If that is not possible, there are relatively simple ways to transaction into a liability-driven plan.

One of the services InvestSense provides is fiduciary prudence oversight services. By using fiduciary prudence and risk management compliance tools such as the AMVR and annuity breakeven analyses, and requiring that all plan advisers and investment consultants document their value-added proposition with such validating documents, a plan sponsor can significantly and efficiently simplify the required administration and monitoring of their 401(k) or 403(b) plan.

Notes

1. 29 CFR § 2550.404(a); 29 U.S.C. § 1104(a).

2. Hughes v. Northwestern University., 142 S. Ct. 737, 211 L. Ed. 2d 558 (2022)

3. Tibble v. Edison International, 135 S. Ct 1823 (2015).

4. Laurent Barras, Olivier Scaillet and Russ Wermers, False Discoveries in Mutual Fund Performance: Measuring Luck in Estimated Alphas, 65 J. FINANCE 179, 181 (2010).

5. Charles D. Ellis, The Death of Active Investing, Financial Times, January 20, 2017, available online at https://www.ft.com/content/6b2d5490-d9bb-11e6-944b-eb37a6aa8e.

6. Philip Meyer-Braun, Mutual Fund Performance Through a Five-Factor Lens, Dimensional Fund Advisors, L.P., August 2016.

7. Mark Carhart, On Persistence in Mutual Fund Performance, 52 J. FINANCE, 52, 57-8 (1997).99

8. Uniform Prudent Investor Act, https://www.uniformlaws.org/viewdocument/final-act-108?CommunityKey=58f87d0a-3617-4635-a2af-9a4d02d119c9 (UPIA).

9. Pension and Welfare Benefits Administration, “Study of 401(k) Plan Fees and Expenses,” (DOL Study) http://www.DepartmentofLabor.gov/ebsa/pdf; “Private Pensions: Changes needed to Provide 401(k) Plan Participants and the Department of Labor Better Information on Fees,” (GAO Study).

10. 29 CFR Section 2509.94-1 )(IB 94-1) and Section 2509.15-1 (IB 15-1).

11. Ross Miller, “Evaluating the True Cost of Active Management by Mutual Funds,” Journal of Investment Management, Vol. 5, No. 1, 29-49 (2007) https://papers.ssrn.com/sol3/papers.cfm?abstract_id=746926.

Copyright InvestSense, LLC 2024. All rights reserved.

This article is for informational purposes only, and is neither designed nor intended to provide legal, investment, or other professional advice since such advice always requires consideration of individual circumstances. If legal, investment, or other professional assistance is needed, the services of an attorney or other professional advisor should be sought