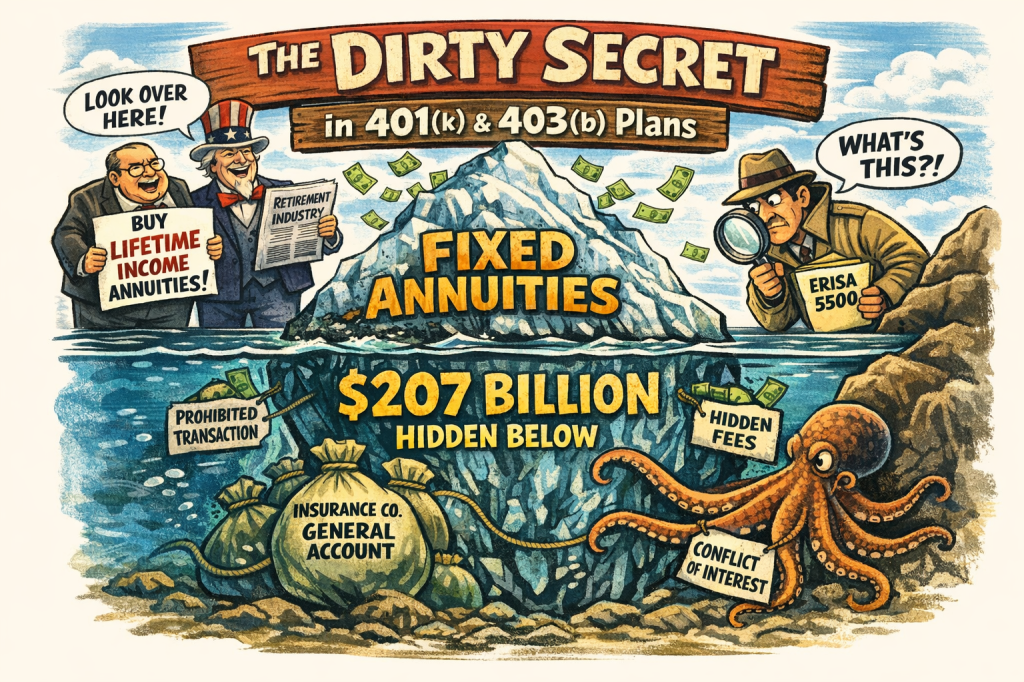

While the trade press, lobbyists, and Congress argue endlessly about putting lifetime income annuities into retirement plans, they are ignoring the much bigger, much quieter, and much more dangerous reality:

Fixed annuities are already everywhere in 401(k) and 403(b) plans.

Not income annuities. Not fancy new products.

Plain vanilla, insurance company general account fixed annuities.

And they have been sitting there for 20 years, largely unnoticed, unexamined, and almost never litigated.

They are the dirty secret of defined contribution plans. By talking endlessly about Lifetime Income Annuities which barely register at under 1%, which sound good, they hope to hide these fixed annuities.

The scale no one talks about

Using the RxTrima ERISA database: 774,172 ERISA plans

725,689 are defined contribution plans (mostly 401(k)s, some ERISA 403(b)s)

The litigation universe (plans > $100 million): 9,010 plans

Of roughly 9,000 plans over $100 million reviewed: 3,579 plans hold fixed annuities

$207 BILLION in plan assets Let that sink in.

While journalists obsess over whether a handful of plans might add lifetime income, thousands of plans already hold hundreds of billions inside insurance company balance sheets.

Breakdown:

Plan Size # of Plans with Fixed Annuities

Over $1B 17

$500M–$1B 27

$300M–$500M 57

$100M–$300M 320

$50M–$100M 482

$30M–$50M 532

$10M–$20M 1,260

Under $10M 700

This is not a niche issue. This is systemic.

Who the major players are

These are not fringe insurers.

Insurer # Plans $Assets

Empower 930 $51.8B

TIAA 392 $58.3B

Principal 612 $20.1B

MassMutual 253 $13.1B

NY Life 300 $11.8B

MetLife 196 $11.2B

Lincoln 194 $8.7B

Transamerica 215 $6.7B

Voya 157 $5.2B

VALIC 93 $3.8B

This is dangerous under ERISA

These are primarily general account contracts. That means:

Plan assets become liabilities of the insurer’s balance sheet.

They are not mutual funds.

They are not CITs.

They are not segregated.

They are loans to the insurance company.

And under ERISA §406:

That is a transfer of plan assets to a party in interest.

Annuities are a prohibited transaction

a https://commonsense401kproject.com/2025/11/01/annuities-are-a-prohibited-transaction-dol-exemptions-do-not-work/

Downgrade provisions

https://commonsense401kproject.com/2026/01/09/retirement-plans-must-demand-downgrade-provisions-for-any-annuity/

TIAA target date illusion, hiding general account annuities

https://commonsense401kproject.com/2026/01/15/tiaas-target-date-funds-are-built-on-a-risk-illusion/

These products violate the basic structure ERISA was designed to prevent.

Why Fixed Annuity Contracts are mostly Secret

Because they hide under different names like:

“Stable value”

“Capital preservation”

“Fixed account”

“Guaranteed account”

“General account GIC”

“Group annuity contract”

And they sit quietly for years paying 2–3% while the insurer earns 5–7% on the same money.

That spread is never disclosed.

Never benchmarked.

And just starting to be litigated.

The industries where this is concentrated

From your notes:

Education (ERISA 403(b)s) —345 plans dominated by TIAA

Medical / hospitals —780 plans heavy Lincoln and others

Financial firms —206 plans led by Principal, Empower

Unions/nonprofits — 274 plans led by Empower, MassMutual

These are exactly the plans plaintiff firms usually ignore because they don’t look like fee cases. Many are 403(b)s

But they are prohibited transaction cases, not fee cases.

The legal environment just changed

Section 783 of the Restatement (Third) of Trusts and the expanding

“knew or should have known” standard in the era of AI means:

Plan fiduciaries can no longer claim they didn’t understand how these products work.

The information is public.

The 5500 shows it.

Schedule A shows it.

The insurance NAIC filings show it.

Ignorance is no longer a defense.

https://fiduciaryinvestsense.com/2025/10/26/implications-of-section-783-of-the-restatement-third-of-trusts-and-the-expanding-knew-or-should-have-known-liability-standard-in-the-era-of-ai/

The real irony

While Congress pushes bills to allow annuities into plans…

There are already 3,500+ plans with $207 billion sitting in annuities that likely never complied with ERISA in the first place.

This is not a future problem.

This is a 20-year-old problem hiding in plain sight.

The punchline

The retirement industry wants you to debate whether lifetime income annuities should be allowed into 401(k)s.

They do not want you to notice that Fixed Annuities are already there, and are a litigation bomb ready to go off.