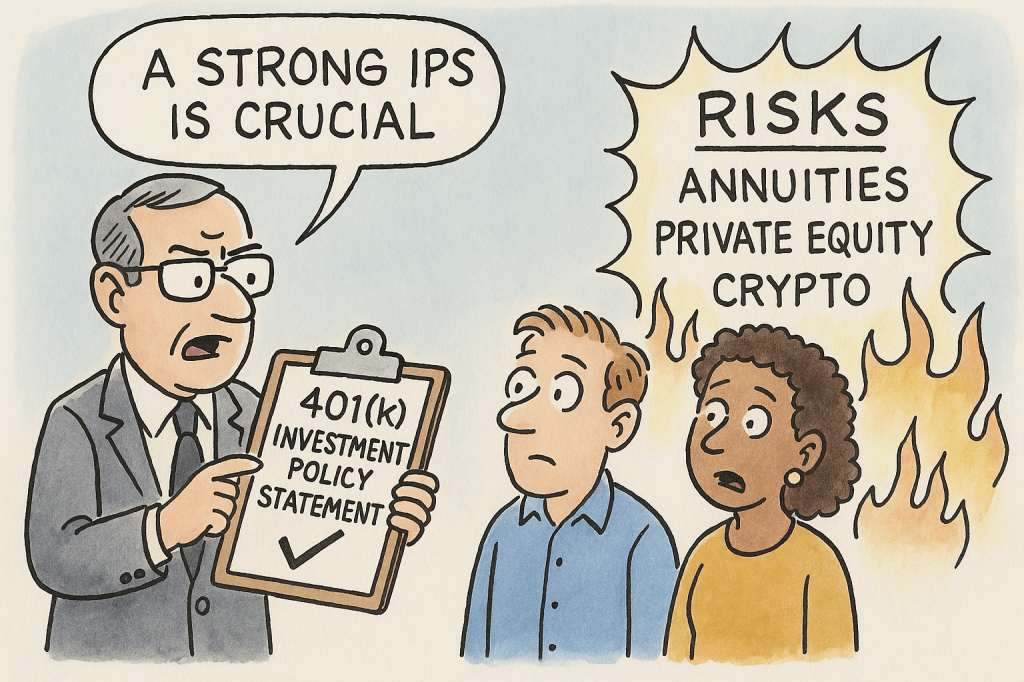

A well-crafted Investment Policy Statement (IPS) is not merely a procedural formality—it is the fiduciary firewall that protects 401(k) plan participants from the encroachment of conflicted, high-fee, and opaque investment products. In the absence of a strong IPS, plan sponsors expose themselves—and their participants—to a host of fiduciary landmines, including private equity, cryptocurrency, and insurance-based annuities that fail the Department of Labor’s Impartial Conduct Standards and risk classification as prohibited transactions under ERISA.

The IPS: Cornerstone of Fiduciary Oversight

“If an employee benefit plan does not have an investment policy statement, it does not have an investment policy.”

— IFEBP Investment Policy Handbook, Eugene Burroughs

A detailed IPS is essential to satisfying the fiduciary duties of prudence, loyalty, and diversification under ERISA. As the CFA Institute’s Pension Trustee Code of Conduct underscores, trustees must “draft written policies that include a discussion of risk tolerances, return objectives, liquidity requirements,” and review these policies at least annually to ensure they remain current.

The Department of Labor (DOL) reaffirmed this in its amicus brief in Pizarro v. Home Depot, stating that vendors have strong incentives to exploit plan design weaknesses, and that ultimate accountability for plan investments resides squarely with the plan sponsor.

From Mutual Funds to Murky Waters: The Rise of CITs and Alternatives

Historically, 401(k) plans were dominated by SEC-registered mutual funds, which provided relatively robust protections via daily pricing, audited disclosures, and strict regulation. Today, over 50% of 401(k) assets are housed in target date funds (TDFs)—and increasingly, these are delivered via poorly state-regulated Collective Investment Trusts (CITs) instead of mutual funds. While CITs promise lower fees, they often come with less transparency, fewer investor protections, and more hidden leverage or illiquid assets.

Without an IPS that explicitly defines allowable structures, asset classes, liquidity limits, and credit quality minimums, plan sponsors may unknowingly allow risky assets like:

- Private credit or private equity vehicles priced internally

- Insurance company annuities backed by opaque general accounts

- Cryptocurrency products that fail liquidity, valuation, and prudence tests

Contract-Based Products and Annuities: Unacceptable Fiduciary Risks Without IPS Controls

The shift toward contract-based investment products—especially fixed annuities within DC plans—is perhaps the most troubling. These investments:

- Fail diversification screens, often representing single-issuer credit exposure

- Lack downgrade provisions (unlike traditional bond funds), leaving participants stuck in junk-rated or insolvent insurance contracts

- Obscure fees and spread profits, particularly in general and separate account annuities

- Violate GIPS performance transparency standards required for prudent monitoring

As noted in Fi360’s Fiduciary Handbook for Plan Stewards, these investments often cannot be valued reliably or marked to market and can present major conflicts of interest—especially when offered by a plan’s recordkeeper.

Each TDF Is a Bundle of Risk: Call for Sub-Policy Statements

According to Ron Surz, co-author of Fiduciary Handbook for Understanding and Selecting Target Date Funds, each target date fund should be governed by its own IPS. This is especially critical as modern TDFs increasingly embed exposure to non-transparent alternatives like:

- Private equity stakes

- Real estate limited partnerships

- Derivatives and synthetic structures

A sound IPS must:

- Disclose the asset-level guidelines within each TDF

- Demand transparency on holdings, fees, and valuation methodology

- Prohibit assets that are not SEC-registered or that lack daily pricing

- Require performance benchmarking against risk-adjusted, diversified indices

Avoiding Prohibited Transactions and Conflicts of Interest

The presence of annuities or proprietary alternative products tied to the recordkeeper or affiliated parties raises red flags for prohibited transaction claims under ERISA §406. Fi360 stresses that fiduciaries must “avoid or manage conflicts of interest in favor of the investors and beneficiaries.” Disclosure alone is insufficient—conflicted investments must be affirmatively excluded or justified via documented due diligence.

As the CFA Institute and Fi360 both emphasize, fiduciaries must:

- Adopt written investment guidelines specifying asset classes and due diligence protocols

- Evaluate each option inside TDFs as if it were a stand-alone fund

- Reject opaque products that cannot meet minimum fiduciary standards for liquidity, transparency, and valuation

Conclusion: A Weak IPS Is a Breach Waiting to Happen

There is growing consensus—from the CFA Institute, Fi360, and the DOL—that weak IPS documents enable fiduciary breaches. Without an IPS that explicitly bans or scrutinizes illiquid, high-risk, or non-transparent investments, sponsors may:

- Breach fiduciary duties of prudence and loyalty

- Invite litigation over prohibited transactions

- Allow vendors to exploit structural loopholes for their own benefit

In short, a strong IPS is a fiduciary necessity, not a formality. It is the legal and ethical framework that separates prudent governance from reckless delegation. It must evolve with the changing landscape of target date funds, CITs, and alternative assets—before it’s too late for participants and plan fiduciaries alike.

Recommended Reading and References

- CFA Institute, Pension Trustee Code of Conduct, 2019

https://www.cfainstitute.org/-/media/documents/code/other-codes-standards/pension-trustee-code-of-conduct-2019.pdf - Fi360, Handbook for Fiduciary Plan Stewards, 2020

www.fi360.com/uploads/media/handbook_stewards_2020.pdf - IFEBP, Investment Policy Handbook, Eugene Burroughs

- DOL Amicus Brief in Pizarro v. Home Depot (11th Cir.)

- Surz, Lohr & Mensack, Fiduciary Handbook for Understanding and Selecting Target Date Funds, 2016

- https://commonsense401kproject.com/2023/03/12/investment-policy-statements-crucial-to-fiduciary-duty/

- https://commonsense401kproject.com/2025/07/09/target-date-benchmarks-chatgpt/

- https://commonsense401kproject.com/2025/06/29/erisa-advisory-council-testimony-released/