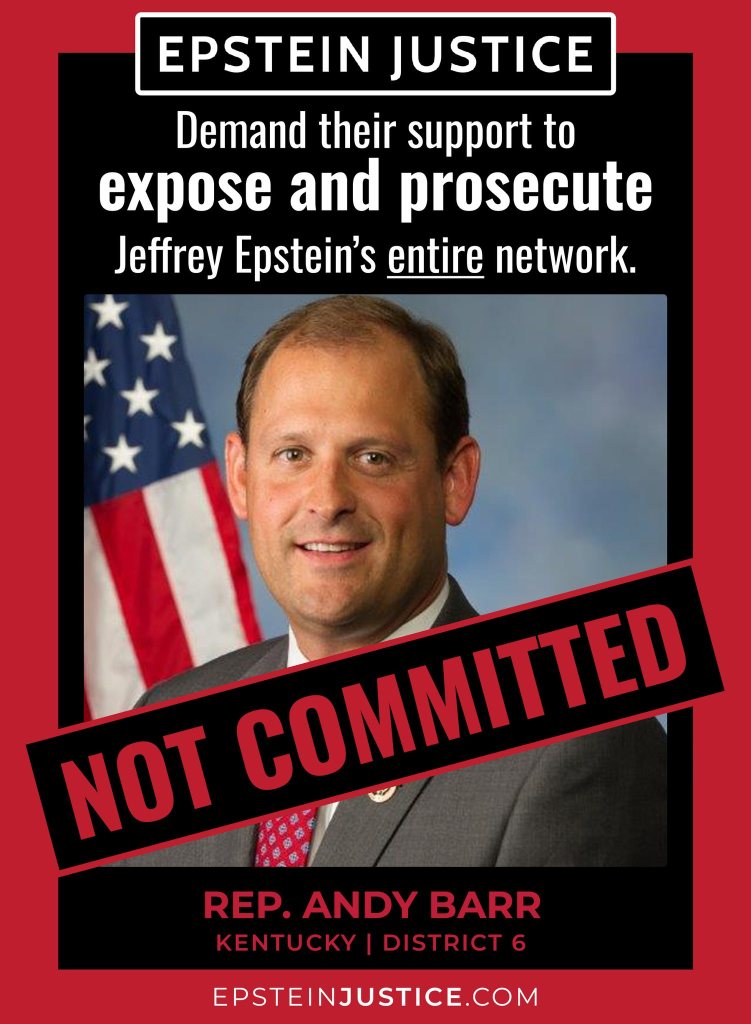

Many members of Congress have received $millions from financial firms linked to Jeffrey Epstein. Andy Barr of KY a member of the US House Financial Services Committee is a good example.

Here’s an in-depth article exploring the network linking Congressman Andy Barr to major financial contributors with ties to Jeffrey Epstein:

Andy Barr’s Financial Industry Backers

Andy Barr’s Financial Industry Backers

Apollo Global Management

Apollo Global Management

- In the 2023–2024 election cycle, Apollo Global Management emerged as one of Barr’s top contributors, donating $55,800 via individuals and PACs Forbes+13OpenSecrets+13Business Insider+13.

- Apollo’s connection to Jeffrey Epstein is well‑documented through its former CEO, Leon Black, who reportedly paid Epstein around $158 million between 2012 and 2017 for tax and estate planning—an arrangement that entangled significant public scrutiny and congressional investigation Vanity Fair+3Axios+3The Daily Beast+3.

JPMorgan Chase & Co.

JPMorgan Chase & Co.

- In the first quarter of the 2025 election cycle, Barr’s campaign received the maximum $10,000 donation from the JPMorgan PAC OpenSecrets.

- JPMorgan’s entanglement with Epstein included a prolonged relationship even after his 2008 criminal conviction, forcing internal compliance to raise red flags as late as 2013 Axios+9Business Insider+9TIME+9.

- In 2022, the bank sued former executive Jes Staley, accusing him of deliberately shielding Epstein and neglecting red flags in order to keep Epstein as a client Axios+3AP News+3TIME+3.

Beyond Apollo and JPMorgan: Other Connections

Barr hasn’t only received funds from these two; he’s also tapped into other banks and private equity firms later scrutinized for Epstein links:

- Wells Fargo: Contributed a total of $39,932 during the 2023–2024 cycle OpenSecrets. While Wells Fargo itself hasn’t been directly linked to Epstein, its high-ranking executives and financial dealings have come under broader oversight as part of financial industry safeguards post-Epstein revelations.

- Blackstone Group: Donated $39,204 in the same cycle OpenSecrets. Co-founded by Stephen Schwarzman, Blackstone has not been tied to Epstein in the same way Apollo was; however, it remains part of the broader private‑equity ecosystem that’s been called to account by investigations like those spearheaded by Senator Ron Wyden Senate Finance Committee.

The Epstein Backdrop

The Epstein Backdrop

- Leon Black’s controversy: The former Apollo CEO paid Epstein nearly $170 million for financial advice—and settled for $62.5 million with the U.S. Virgin Islands over his alleged enabling of Epstein’s illicit activities AP News+4The Daily Beast+4Forbes+4.

- JPMorgan’s long delay: The bank kept Epstein as a client until 2013, despite internal concerns following his 2008 guilty plea The New Yorker.

Linking the Dots: Barr & Epstein-Linked Money

| Funder | Amount Donated | Epstein Link |

|---|---|---|

| Apollo Global Management | $55,800 | Leon Black payments to Epstein; public controversy |

| JPMorgan Chase PAC | $10,000 | Bank’s long relationship; executive lawsuit involvement |

| Wells Fargo | $39,932 | Part of general financial ecosystem with Epstein oversight |

| Blackstone Group | $39,204 | Ecosystem affiliation; under scrutiny in Epstein probe |