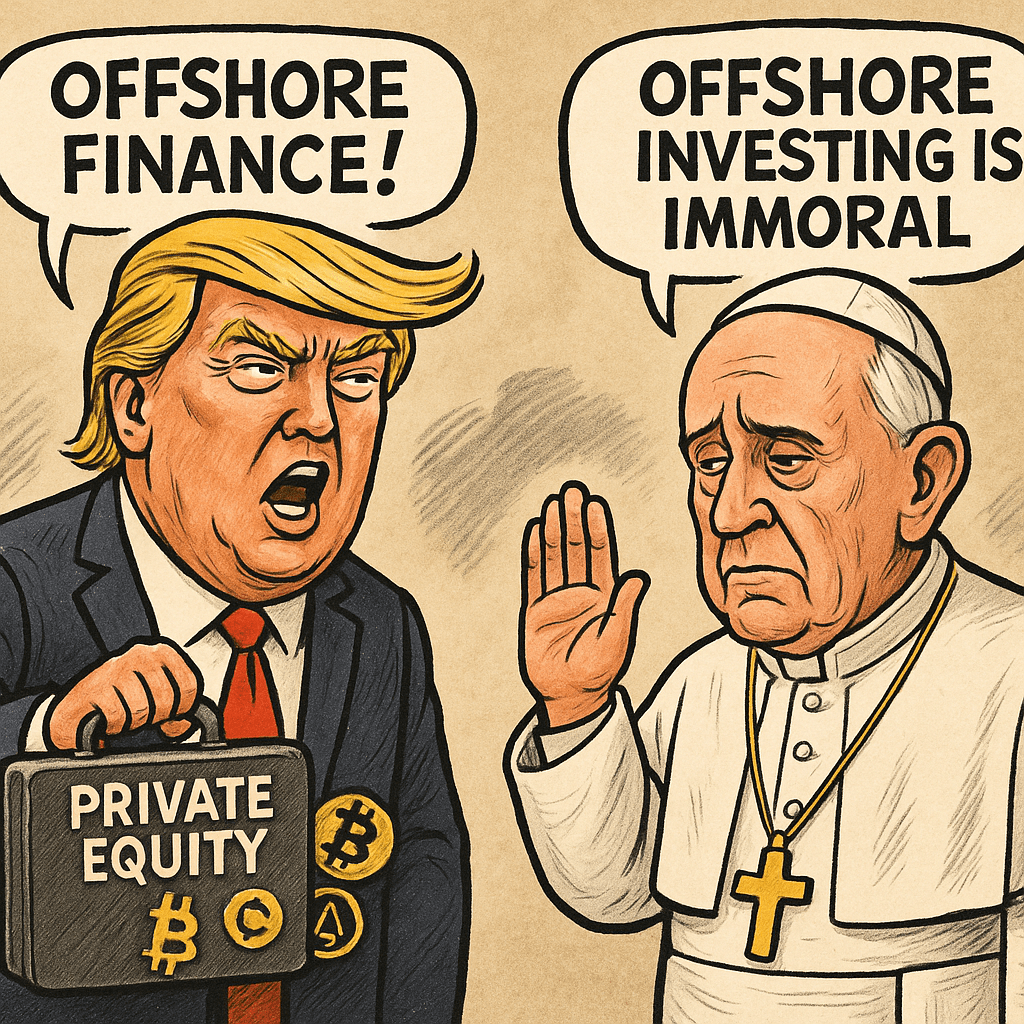

When it comes to offshore money games, Donald Trump has chosen the side of secrecy, speculation, and Wall Street greed — in direct opposition to the moral vision of the Catholic Church.

In 2018, the Vatican under Pope Francis issued a landmark rebuke of offshore finance. In Oeconomicae et pecuniariae quaestiones, the Holy See declared:

“The offshore system constitutes an opportunity for illegal financial operations and grave disordered conduct… that are capable of destabilizing the entire world economic system.”

The Vatican condemned tax havens, shell companies, and shadow finance, insisting that:

“Such practices tend to enrich only a few while harming the common good.”

Francis made clear that offshore secrecy was not clever capitalism, but a betrayal of human dignity. Following his death, Pope Leo has pledged to carry on this mission, reaffirming Francis’ call for transparency and stewardship over speculation and greed.

Trump’s Offshore Gift

Trump, however, has planted his flag on the opposite side. His Department of Labor’s Advisory 2025-04A delivers a multi-billion dollar gift to private equity, crypto, and insurance giants — encouraging offshore vehicles to flow directly into 401(k) retirement plans.

Where Francis and Leo denounce offshore secrecy as immoral, Trump is institutionalizing it.

Wall Street Allies in the Shadows

The real beneficiaries are Trump’s Wall Street allies:

- Apollo Global Management, tied to offshore annuity giant Athene.

- Blackstone, the world’s largest private equity firm, with billions routed through the Caymans and Luxembourg.

- KKR, which relies heavily on offshore private credit funds.

- Prudential, MetLife, TIAA, and Lincoln Financial, insurers that reinsure risky annuities through Bermuda to avoid U.S. oversight.

- Crypto promoters seeking Cayman-style secrecy while flooding into retirement accounts.

These players gain the secrecy, fees, and leverage they want — while ordinary teachers, nurses, and factory workers bear the risk.

Offshore Products, Legal Landmines

As I’ve written, these offshore annuities and private equity funds are riddled with ERISA prohibited transaction risks — from undisclosed spread profits to “party in interest” conflicts.

The Vatican warned precisely against this kind of abuse:

“Money must serve, not rule. Financial speculation, driven by an aim for maximum profit, without regard for the common good, endangers the stability of the entire system.”

Trump’s DOL is not preventing such dangers — it is writing them into the rulebook.

Who Gets Hurt?

The largest 401(k) plans — about 8,000 with more than $100 million in assets — are the ones most likely to be litigated when fiduciary abuses occur. But the offshore promoters aren’t stopping there. They are targeting smaller 401(k)s, public pensions, 457s, 403(b)s, and individual annuity buyers, where litigation risk is minimal and oversight weak.

This is precisely the scenario the Vatican condemned: the powerful exploiting regulatory gaps while ordinary people carry the risk.

The Moral Divide

- Pope Francis (and now Pope Leo): Offshore secrecy is immoral, destabilizing, and corrosive to the common good.

- Donald Trump and his Wall Street allies: Offshore finance is a profit machine, and workers’ 401(k)s are the next feeding trough.

Trump has not just ignored the Vatican’s call for ethical finance — he has actively reversed it. If Francis stood for transparency and justice, Trump stands for opacity and greed. If Pope Leo carries on Francis’ moral warning, Trump functions as its antithesis: the Anti-Pope of offshore investing.

https://press.vatican.va/content/salastampa/en/bollettino/pubblico/2018/05/17/180517a.html

https://commonsense401kproject.com/2025/10/24/why-offshore-private-equity-and-private-credit-pose-erisa-prohibited-transaction-risks/ https://commonsense401kproject.com/2025/10/23/why-offshore-structures-and-weak-state-regulation-make-most-annuities-erisa-prohibited-transactions/