Introduction — Beyond Disclosure, Into violating ERISA Fiduciary Law

This Appendix analyzes how the embedding of lifetime income annuity elements inside Target-Date Funds (TDFs) violates core provisions of the Employee Retirement Income Security Act (ERISA). It updates the analysis laid out in:

Annuities Are a Prohibited Transaction — DOL Exemptions Do Not Work (Nov. 1, 2025), https://commonsense401kproject.com/2025/11/01/annuities-are-a-prohibited-transaction-dol-exemptions-do-not-work/

401(k) Lifetime Income: A Fiduciary Minefield (Feb. 10, 2022), https://commonsense401kproject.com/2022/02/10/401k-lifetime-income-a-fiduciary-minefield/

Wall Street Journal Exposes Target-Date CIT Corruption… (Dec. 7, 2025), https://commonsense401kproject.com/2025/12/07/wall-street-journal-exposes-target-date-cit-corruption-but-theyve-only-scratched-the-surface/

By examining the structure of modern TDFs — particularly those using state-regulated CITs and insurance-wrapped annuity components — this Appendix explains why such constructions are not merely risky or opaque, but in many cases incompatible with ERISA’s fiduciary duties of prudence, loyalty, and prohibited-transaction regime.

2. Lifetime Income “Guarantees” Inside TDFs: Substance Over Form

Target-Date Funds increasingly include lifetime income features — either through internal sub-portfolios or embedded insurance wrappers — promising participants “guaranteed income for life.” But these guarantees are not financial alchemy; they derive from general-account fixed annuities and similar insurance obligations that:

- Are backed by the balance sheet of a single insurer;

- Are priced using internal actuarial assumptions, not market pricing;

- Depend on insurer discretion over crediting rates and contractual terms;

- Obscure spread-based profits and other indirect compensation.

As explained in Annuities Are a Prohibited Transaction, these characteristics are not neutral features — they are economic modalities that define an insurance contract, not a diversified investment. Embedding them inside TDFs does not change their legal character; it simply hides them behind the Target-Date label. Atty. Jim Watkins has more at https://fiduciaryinvestsense.com/2026/01/04/upon-further-review-the-3-x-3-analysis-that-shows-why-prudent-plan-sponsors-will-never-offer-annuities-within-their-plan/

3. ERISA §404 — Breaches of Prudence and Loyalty

ERISA §404(a)(1)(B) and (C) require fiduciaries to act with the care, skill, prudence, and diligence of a prudent expert and to diversify plan investments to minimize the risk of large losses.

A. Imprudent Integration of Insurance Risk

Lifetime income annuity elements impose single-entity credit risk on participants because the guarantees depend entirely on the solvency and internal pricing of one insurer’s general account. As has been documented in the TDF corruption analysis, investors often do not even realize they hold such exposures because:

- TDFs use state-regulated CIT structures that mask the insurance component,

- Consultants and recordkeepers classify these as “stable income” or “income enhancement.”

But from an economic perspective, a TDF containing a general-account annuity is functionally similar to a 401(k) that has placed a portion of participant assets into a fixed annuity inside an insurance general account — a structure courts have found problematic and ERISA fiduciaries must evaluate rigorously.

B. Improper Diversification

Diversification requires more than a target asset mix; it demands avoidance of undiversified exposures that can materially threaten principal. Embedding a single insurer’s guarantee into a diversified TDF portfolio does not diversify the insurer credit risk; it adds an undiversified risk factor.

The duty of loyalty is similarly breached when fiduciaries accept such exposures without transparent analysis and without evidence that the supposed lifetime income benefits outweigh the concentrated risk and fee opacity.

4. ERISA §406 — Hidden Prohibited Transactions

ERISA §406(a) prohibits plan assets from being used in transactions involving a party in interest, including insurers and service providers, unless an exemption applies.

A. The Per Se Nature of Annuity Transactions

Lifetime income guarantees embedded in TDFs are derived from contractual relationships with insurers or their affiliates — parties in interest. Even if indirectly accessed through a CIT, the economic reality is that:

- Plan assets are committed to support insurance liabilities;

- Insurers extract spread income and embedded profits;

- Affiliated service providers benefit financially.

This meets the definition of a §§406(a) prohibited transaction: the plan transfers value to a party in interest, often in the form of fees and spread retention, without contemporaneous best-interest justification.

B. Failure of Prohibited-Transaction Exemptions

As detailed in Annuities Are a Prohibited Transaction, typical regulatory exemptions (e.g., PTE 84-24, PTE 2020-02) often cannot apply because lifetime income products:

- Fail to disclose all compensation clearly;

- Lack meaningful downgrade or termination provisions;

- Do not center participants’ best interests;

- Are structured with conflicts (e.g., insurer also acting as recordkeeper).

Thus, even if promoters claim exemption compliance, the underlying economics do not satisfy the statutory criteria.

5. Citations from the TDF Corruption WSJ Analysis: Valuation and Transparency Risk

The Wall Street Journal story When Your Private Fund Turns $1 Into 60 Cents underscores a related structural issue: valuation opacity. When private assets once thought to be “stable” were exposed to market pricing, they collapsed in value. This same dynamic exists, often unobserved, in TDFs that:

- Hold non-transparent, non–market-priced private assets;

- Embed insurance guarantees with discretionary valuations;

- Report net asset values that are not subject to real-time market verification.

State-regulated CITs serve as the vehicle that allows this opacity to be recorded on participant statements as if it were transparent, diversified investment exposure. This practice is inconsistent with ERISA fiduciary norms requiring accurate valuation and disclosure.

6. ERISA’s Prohibition on Conflicted Compensation

ERISA §408(b)(2) demands that compensation be reasonable and disclosed. Lifetime income guarantees inside TDFs obscure significant compensation:

- Insurance spreads not captured in traditional fee tables;

- Embedded guarantee costs not disclosed as numeric fees;

- Ancillary revenues to affiliates (e.g., asset-management fees, revenue sharing).

This is precisely the kind of undisclosed economic benefit that ERISA’s prohibited transaction and fiduciary standards were designed to prevent.

8. Participant Harm — The Ultimate Consequence

Lifetime income elements inside TDFs:

- Increase cost without commensurate benefit;

- Conceal risk behind “guarantee” language;

- Reduce liquidity and choice;

- Mask fees through the attribution of spread income;

- Potentially deliver lower lifetime wealth than diversified non-annuitized options.

This harm is not speculative; it is structural.

9. Conclusion: Structural Incompatibility with ERISA

Lifetime income annuity components hidden within Target-Date Funds — particularly in state-regulated CIT structures — are not merely risky investment choices. They are:

- Undiversified exposures, violating ERISA §404(a)(1)(C);

- Prohibited transactions with parties in interest under ERISA §406(a);

- Inconsistent with required fiduciary processes, including valuation, disclosure, and conflict management.

Policymakers, litigators, and fiduciaries alike must recognize that the packaging of insurance guarantees inside TDFs does not transform them into safe, diversified investment exposures.

It transforms them into trust law liabilities waiting to be litigated.

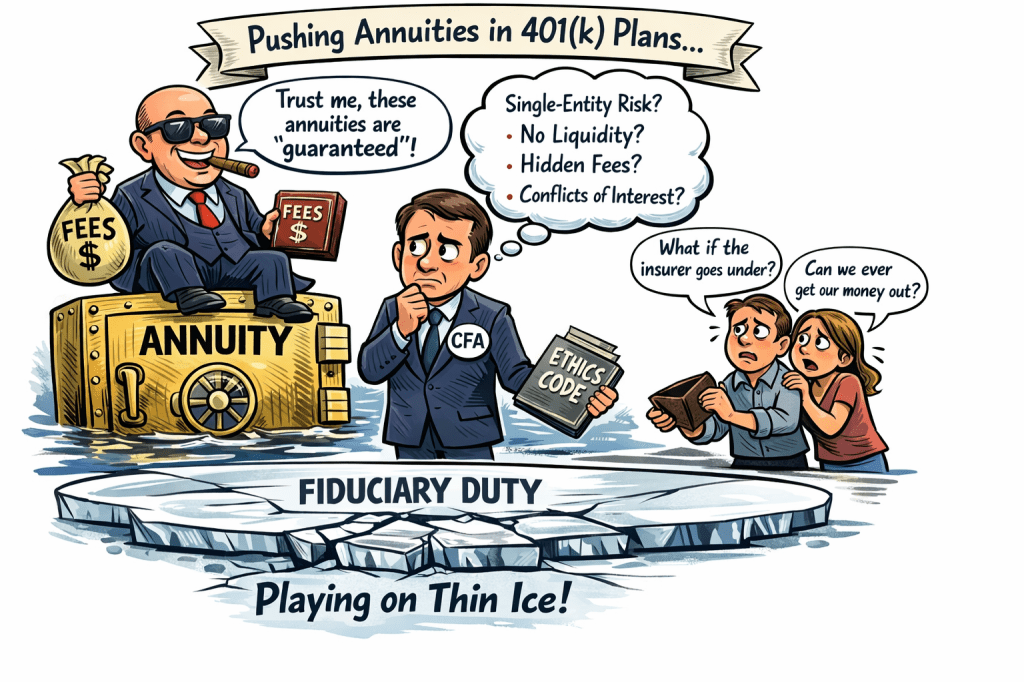

I.APPENDIX Introduction: Annuities as a CFA Ethics Issue, Not Merely an ERISA Issue

A few CFA charterholders has begun actively promoting lifetime annuities in 401(k) plans, often framing these products as prudent solutions to longevity risk. As discussed in 401(k) Lifetime Income: A Fiduciary Minefield (Commonsense 401k Project, Feb. 10, 2022), this framing ignores fundamental fiduciary risks embedded in annuity products—particularly single-entity credit risk, illiquidity, opaque pricing, and conflicts of interest.

While ERISA fiduciary standards already raise serious concerns, CFA Institute fiduciary and ethical standards are at least as strict—and in several respects stronger. CFA charterholders are bound not only by applicable law (including ERISA), but by an independent professional code that places client interests, transparency, and integrity of the profession above product sales or industry narratives.

This appendix demonstrates that actively recommending annuities in 401(k) plans may run afoul of multiple CFA Institute standards, particularly where the risks and conflicts inherent in annuities are minimized, obscured, or ignored.

II. CFA Institute Pension Trustee Code: Knowledge, Liquidity, and Prudence

The CFA Institute Pension Trustee Code of Conduct makes explicit that effective fiduciaries must understand:

“How investments and securities are traded, their liquidity.”

(CFA Institute Pension Trustee Code of Conduct, p. 13)

This requirement is critical for annuities.

A. Liquidity Failures of Annuities

Lifetime annuities in 401(k) plans typically:

- Cannot be traded,

- Cannot be priced daily by a market,

- Cannot be exited without penalty,

- Are subject to insurer-controlled crediting rates and withdrawal restrictions.

A CFA charterholder who recommends a product whose liquidity disappears precisely when credit risk rises is failing the Code’s requirement of competence and diligence. Liquidity risk is not ancillary—it is central to DC plan design, where participants may need to rebalance, roll over, or withdraw assets.

III. Core Fiduciary Obligations Under the CFA Pension Trustee Code

The Pension Trustee Code requires fiduciaries to:

- Act in good faith and in the best interests of participants

- Act with prudence and reasonable care

- Act with skill, competence, and diligence

- Maintain independence and objectivity

- Avoid conflicts of interest

- Communicate transparently and accurately

Each of these principles is strained—if not violated—by annuity recommendations.

A. Prudence and Diversification

Diversification is a foundational fiduciary principle. Annuities concentrate participant assets in a single insurer, creating uncompensated single-entity credit risk. This violates both ERISA §404(a)(1)(C) and CFA prudence standards.

CFA charterholders routinely criticize concentrated credit exposure in bond portfolios—yet often ignore the same risk when it is embedded in an insurance product.

B. Transparency and Communication

Annuities:

- Do not disclose spread-based compensation in a form comparable to expense ratios,

- Do not disclose CDS-implied credit risk,

- Do not provide transparency into offshore reinsurance or private credit backing liabilities.

Recommending such products without full transparency conflicts directly with the obligation to communicate accurately and transparently with beneficiaries.

IV. “Putting Clients First”: The CFA Code of Ethics

Every CFA charterholder annually affirms adherence to the CFA Code of Ethics and Standards of Professional Conduct, including the obligation to:

“Place the integrity of the investment profession and the interests of clients above their own personal interests.”

This is the essence of fiduciary duty.

A. Annuities and Asymmetric Incentives

Annuities generate profits through:

- Spread income,

- Illiquidity,

- Opacity,

- Long-dated lock-in.

These features benefit insurers and intermediaries—not participants. When CFA charterholders promote annuities while downplaying these structural incentives, they elevate product narratives over client welfare.

V. Application of CFA Standards to Annuities

Standard III(A): Loyalty, Prudence, and Care

Insurers exploit information asymmetry, :

- Complexity,

- Illiquidity,

- Participant unfamiliarity with insurance accounting.

Recommending such products without full disclosure fails the duty to act for the benefit of clients.

Standard III(B): Fair Dealing

In annuities, insurers reserve discretion over:

- Crediting rates,

- Portfolio allocation,

- Reinsurance structures.

Participants bear downside risk, while insurers retain upside discretion—mirroring the “GP discretion” clauses widely criticized in PE LPAs.

Standard III(D): Performance Presentation

Annuity performance is often:

- Presented using smoothed or declared rates,

- Not benchmarked to appropriate alternatives,

- Compared misleadingly to money market funds rather than diversified stable value funds.

This selective presentation is inconsistent with fair and complete performance communication.

Standard VI(A): Conflicts of Interest

Conflicts arise where:

- Insurers also serve as recordkeepers,

- Consultants have relationships with insurers,

- Products generate hidden spread income.

Failure to disclose or mitigate these conflicts violates CFA conflict-of-interest standards.

Standard VI(B): Priority of Transactions

Annuities prioritize insurer balance-sheet management over participant flexibility—similar to PE structures that prioritize GP economics over LP outcomes.

Standard VI(C): Fee Disclosure

Just as PE firms have been sanctioned for undisclosed fees, annuity providers:

- Fail to disclose spread income,

- Embed costs in opaque crediting rates,

- Avoid standardized fee reporting.

CFA charterholders who accept this opacity are applying a double standard.

Standard VII(A): Conduct as a CFA Charterholder

By recommending products that violate principles of:

- Transparency,

- Diversification,

- Liquidity,

- Conflict avoidance,

CFA charterholders risk cheapening the CFA designation itself

VI. “50 Ways to Restore Trust in the Investment Industry”—Applied to Annuities

The CFA Institute’s 50 Ways to Restore Trust emphasizes:

- Naming unethical behavior,

- Advocating for stronger investor protections,

- Refusing willful ignorance,

- Holding bad actors accountable.

Silence around annuity risks—particularly by CFA charterholders—runs counter to this mandate. Ignoring annuity conflicts because they are “legal” or “industry standard” is precisely the ethical failure the CFA Institute has warned against.

VII. Conclusion: Annuities as an Ethical Stress Test for the CFA Profession

Pushing annuities into 401(k) plans is not merely a product choice—it is an ethical stress test for fiduciaries and CFA charterholders.

- Annuities violate diversification principles.

- They suppress risk-mitigation tools like downgrade provisions and CDS analysis.

- They depend on opacity and illiquidity for profitability.

- They expose participants to risks they cannot manage or exit.

Under CFA standards—particularly the Pension Trustee Code and the Code of Ethics—putting clients first requires resisting products whose economics depend on clients not fully understanding the risks.

If CFA charterholders apply to annuities the same ethical scrutiny they apply to other assets, many annuity recommendations in 401(k) plans would be indefensible.

Pingback: Annuities Are a Prohibited Transaction — DOL Exemptions Do Not Work Update 1/4/26 | The CommonSense 401k Project