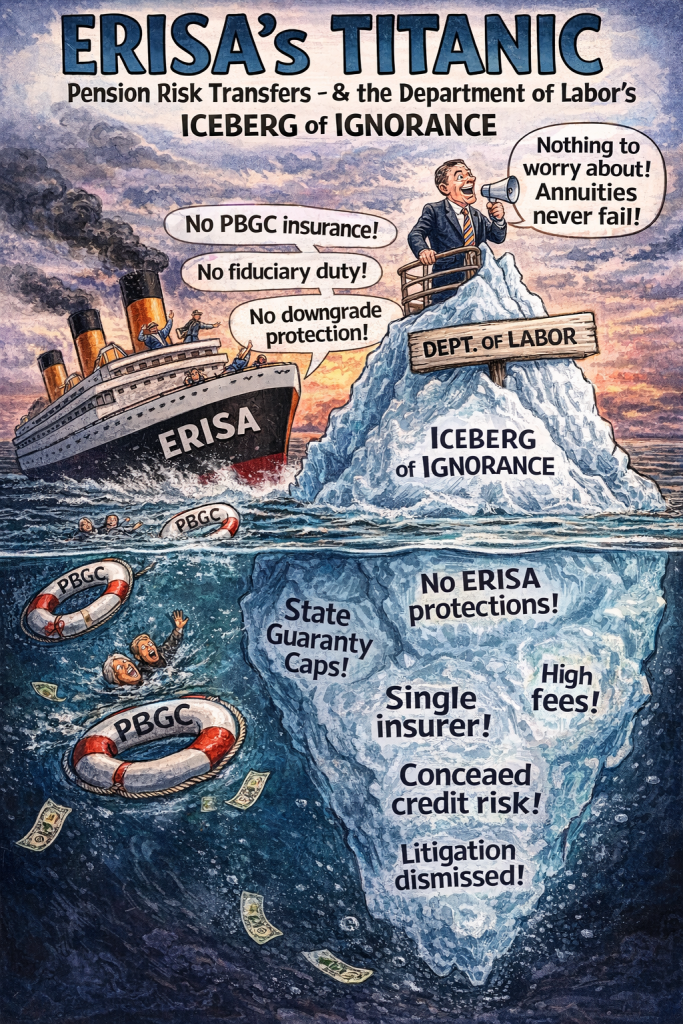

On January 9, 2026, the U.S. Department of Labor filed an amicus brief defending Pension Risk Transfer (PRT) annuities—arguing, astonishingly, that stripping retirees of ERISA protections, PBGC insurance, and diversified pension trusts causes no material harm to participants.

That position is not just wrong. It is dangerous.

This brief is not a neutral statement of law. It is an industry advocacy document that—if accepted by courts—would effectively legalize the quiet dismantling of defined benefit pensions, one annuity contract at a time.

Below is why the DOL’s position is fundamentally inconsistent with ERISA, economics, and basic fiduciary duty.

1. The DOL’s Central Fiction: “Nothing Material Changes for Participants”

The DOL claims that when a pension is transferred to an insurer via a PRT, participants are “entitled to the same benefits” and therefore suffer no cognizable harm.

This is demonstrably false.

When a PRT occurs, participants immediately lose:

- PBGC insurance — a federal backstop worth hundreds of thousands of dollars per participant

- ERISA Title I fiduciary protections — prudence, loyalty, prohibited transaction rules

- Federal disclosure and reporting rights

- Diversification of backing assets — replaced with a single insurer credit

- Any ability to enforce ERISA standards going forward

Calling this “no material change” is like saying replacing a diversified investment portfolio with a single unsecured corporate bond is “economically equivalent.”

It isn’t.

And everyone in finance knows it.

https://www.dol.gov/newsroom/releases/ebsa/ebsa20260109-0

👉 See:

- PRTs: Why Courts Keep Ignoring the Dangers

https://commonsense401kproject.com/2025/11/06/prts-why-courts-keep-ignoring-the-dangers-of-pension-risk-transfer-annuities-and-why-these-cases-must-be-appealed/

2. PBGC Insurance Is Real Money — Not a Technicality

The DOL brief treats PBGC insurance as if it were a formality that can be discarded without consequence.

That position collapses under basic math.

PBGC publishes maximum guaranteed benefits every year. For a retiree age 65 in 2025, the present value of PBGC protection exceeds $1.1 million. Lose that protection, and the participant bears the full downside risk of insurer impairment, downgrade, or insolvency.

After a PRT:

- PBGC coverage is gone forever

- State guaranty associations are capped, fragmented, and far weaker

- There is no federal backstop

If PBGC insurance were meaningless, Congress would not have created it, funded it, or regulated it for 50 years.

👉 See:

- DOL’s Flawed PRT Report

https://commonsense401kproject.com/2025/10/24/dols-pension-risk-transfer-flawed-report/

3. The Brief Abuses Thole to Create Fiduciary Immunity

The DOL leans heavily on Thole v. U.S. Bank to argue that participants lack standing unless insurer failure is “certainly impending.”

This is a gross misapplication of Thole.

Thole addressed fluctuations in plan investments within an ongoing ERISA plan. It did not bless fiduciaries’ ability to:

- Strip statutory protections

- Transfer participants to weaker legal regimes

- Ignore credit and downgrade risk

- Concentrate retirement security in a single insurer

Loss of ERISA protections and PBGC insurance is a present injury, not a speculative one.

Under the DOL’s logic, fiduciaries could sell pensions to any insurer—no matter how risky—so long as collapse has not yet occurred.

That would turn ERISA into a “wait until retirees are harmed” statute, which is the opposite of what Congress intended.

4. IB 95-1 Is Being Quietly Rewritten as a “Check-the-Box” Safe Harbor

The DOL insists that Interpretive Bulletin 95-1 is purely about “process,” not outcomes.

That is revisionist history.

IB 95-1 requires fiduciaries to act for the purpose of obtaining the safest available annuity. Safety is not a memo. It is a risk outcome.

Yet under the DOL’s litigation posture:

- CDS spreads are ignored

- Downgrade risk is ignored

- Contractual lock-ins are ignored

- Lack of termination or portability rights is ignored

A “process” that predictably results in riskier annuities is not prudent. It is negligent.

5. The Most Damning Omission: Downgrade Risk Doesn’t Exist (According to DOL)

The amicus brief never seriously grapples with downgrade risk—the single most important risk in long-dated annuity contracts.

PRT annuities typically:

- Lack downgrade-trigger exit rights

- Lack of collateral posting requirements

- Lock participants into deteriorating credits

- Transfer upside to insurers, downside to retirees

Without downgrade provisions, participants are trapped in a slow-motion credit failure with no remedy.

If PRT annuities were truly safe, insurers would offer downgrade protections.

They don’t—because doing so would reduce profits and increase capital requirements.

👉 See:

- Retirement Plans Must Demand Downgrade Provisions for Any Annuity

https://commonsense401kproject.com/2026/01/09/retirement-plans-must-demand-downgrade-provisions-for-any-annuity/

6. “No Annuity Has Ever Failed” Is Not a Fiduciary Standard

The DOL reassures courts that no PRT annuity has failed yet.

That argument has been used before:

- Subprime CDOs (pre-2008)

- AIG Financial Products

- Silicon Valley Bank

ERISA is a forward-looking fiduciary statute, not a tombstone statute.

By the time an annuity fails, retirees have already lost.

7. ERISA Was Designed to Avoid Exactly This Outcome

The DOL’s brief celebrates the shift from federal ERISA protections to state insurance regulation.

That is historically backwards.

ERISA was enacted because:

- State regulation was fragmented

- Workers were unprotected

- Promises were broken

PRTs reverse that progress—quietly and permanently.

The Bottom Line

The Department of Labor’s PRT amicus brief is not pro-worker.

It is pro-insurer, pro-employer, and anti-enforcement.

If courts adopt this framework:

- Fiduciaries will be immune from scrutiny

- PBGC protections can be stripped without consequence

- Downgrade risk will be ignored

- ERISA will become unenforceable until after retirees are harmed

That is not statutory interpretation.

It is regulatory surrender.

PRT cases must be appealed—not just for retirees today, but to preserve the very idea that ERISA means something tomorrow.

Appendix: How Courts Are Weaponizing Thole to Immunize Pension Risk Transfers — The Verizon Case Study

The recent dismissal of the Verizon Pension Risk Transfer (PRT) case by Judge Alvin Hellerstein is a textbook example of how Thole v. U.S. Bank is being misused to eviscerate ERISA’s core protections for defined-benefit pension participants. The decision illustrates precisely why the Department of Labor’s January 2026 PRT amicus brief is so dangerous—and why appellate courts must intervene.

1. The Verizon Plaintiffs Alleged Immediate, Concrete Harm — Not Speculative Injury

The Verizon retirees alleged far more than abstract risk. According to the First Amended Complaint, Verizon transferred $5.7 billion in pension assets covering 56,000 retirees to Prudential (PICA) and RGA, permanently removing participants from:

- ERISA Title I fiduciary protections

- PBGC insurance coverage

- Uniform federal disclosure and enforcement rights

The complaint details that retirees went from uncapped, lifetime PBGC protection to state guaranty association caps—often $250,000–$500,000 per lifetime, depending on state of residence, with immediate haircut risk in states like California (80% cap) 2025-04-25 [dckt 55] PL FIRST A…. in addition the solvency of State guarantee associations are https://commonsense401kproject.com/2025/06/24/state-guarantee-associations-behind-annuities-are-a-joke/ That is not conjecture. That is quantifiable, present economic harm.

Yet the court dismissed the case on standing grounds, holding that because benefits were still being paid today, no Article III injury existed.

2. This Is Not Thole — This Is the Destruction of Statutory Rights

Thole involved participants in an ongoing defined-benefit plan complaining about plan-level investment losses where benefits remained fully guaranteed by the sponsor and PBGC.

The Verizon case is fundamentally different:

| Thole | Verizon PRT |

|---|---|

| Plan remained intact | Plan terminated |

| ERISA protections remained | ERISA protections eliminated |

| PBGC backstop intact | PBGC backstop extinguished |

| Sponsor still liable | Sponsor fully discharged |

Judge Hellerstein nevertheless treated the case as indistinguishable from Thole, holding that loss of ERISA protections, PBGC insurance, and federal enforcement rights is not a cognizable injury unless and until an insurer fails 2026-01-08 [dckt 97] Opinion An….

That reasoning converts ERISA into a post-collapse remedy, not a preventive fiduciary statute.

3. The Court Ignored Congress’s Explicit Response to Executive Life

The Verizon complaint correctly traced Congress’s reaction to the Executive Life collapse, which wiped out tens of thousands of annuitized retirees in the early 1990s. Congress responded with:

- The Pension Annuitants Protection Act (PAPA)

- A new statutory cause of action under ERISA § 502(a)(9)

- DOL’s Interpretive Bulletin 95-1, requiring fiduciaries to seek the safest available annuity

The Verizon court acknowledged these statutes—but rendered them meaningless by holding that participants cannot sue until after catastrophe strikes.

That reading nullifies § 502(a)(9) entirely.

4. Downgrade Risk Was Pleaded — and Ignored

The Verizon plaintiffs alleged detailed facts showing that PICA and RGA:

- Relied heavily on affiliated captive reinsurers

- Used Modified Coinsurance (ModCo) to inflate capital ratios

- Had affiliated exposures exceeding $72 billion, dwarfing surplus

- Operated through regulation-light jurisdictions

These are not default allegations. They are downgrade-pathway allegations—exactly the type of slow-motion credit deterioration that destroys annuity value long before insolvency.

Yet the court dismissed these allegations as irrelevant because no payment had yet been missed.

This mirrors the DOL amicus brief’s central flaw: treating annuity credit risk as binary (fail / not fail) rather than probabilistic and dynamic.

5. The Decision Confirms the Worst-Case Scenario of the DOL’s Amicus Brief

The DOL argues that participants lack standing to challenge PRTs absent imminent insurer collapse. The Verizon decision shows where that logic leads:

- Fiduciaries may ignore downgrade risk

- Fiduciaries may choose cheaper, riskier annuities

- Fiduciaries may strip PBGC protection without consequence

- Courts will dismiss suits with prejudice

In Verizon, the court did exactly that—dismissing the case with prejudice, despite extensive factual allegations, expert declarations, and historical precedent.

6. The Practical Result: ERISA Becomes Unenforceable in PRT Cases

Under the Verizon / DOL / Thole framework:

- A participant cannot sue before a downgrade

- Cannot sue after a downgrade

- Cannot sue until benefits are cut

- And by then, ERISA no longer applies

This is not statutory interpretation.

It is functional repeal by judicial doctrine.

Bottom Line

The Verizon decision is not an outlier. It is the inevitable outcome of the DOL’s current litigation posture on PRTs.

By misusing Thole, courts are transforming ERISA from a protective fiduciary statute into a “wait-for-collapse” regime—exactly the failure Congress sought to prevent after Executive Life.

This case should not be the model.

It should be the warning.

Why This Appendix Matters

This appendix demonstrates, with a real case and a real dismissal, that the DOL’s amicus brief is not theoretical harm—it is already reshaping outcomes. Courts are no longer asking whether annuities are safe. They are asking only whether retirees have already been harmed.

By then, it is too late.