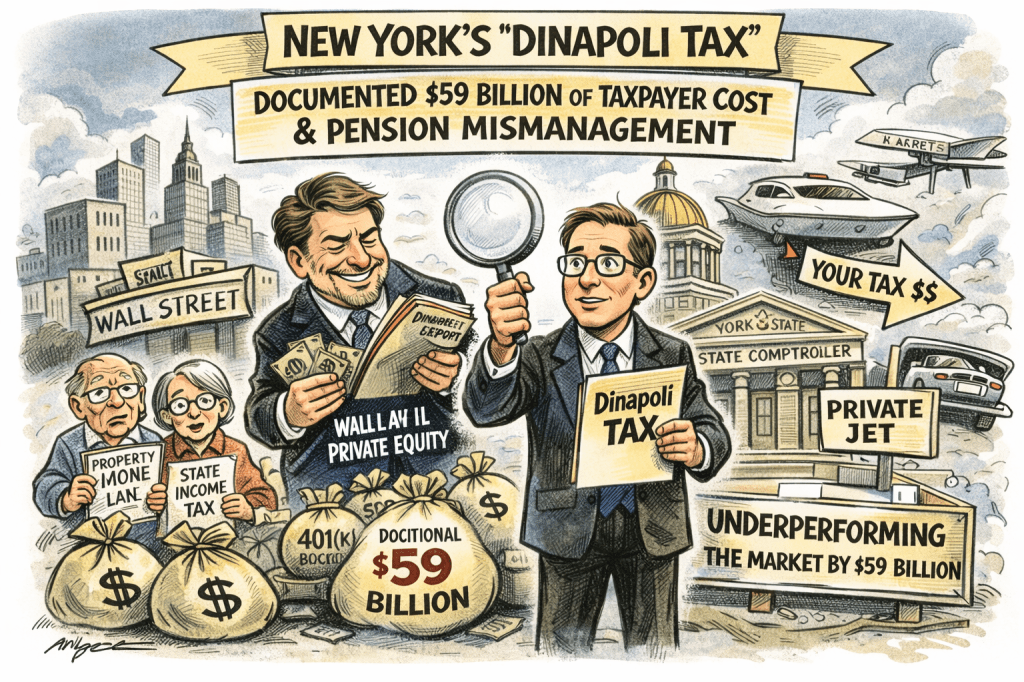

In New York, the Comptroller is the sole trustee of the pension. Candidate Drew Warshaw has published a study that the $59 billion in excess fees is borne by NY Taxpayers and is essentially a tax. https://www.drewwarshaw.com/ideas/dinapolitax

The incumbent Comptroller Thomas DiNapoli issued a press release in response. https://www.osc.ny.gov/press/releases/2026/01/dinapoli-independent-review-finds-state-pension-fund-operates-highest-ethical-and-professional in response

The Warshaw report “DiNapoli Tax” frames Fees as a Hidden Tax: How Underperformance Becomes a Public Burden. The DiNapoli Tax framework does something pension insiders rarely want done it treats investment fees and underperformance as a form of taxation.

Here’s the chain—simple but devastating: Private-market-heavy portfolios underperform investable benchmarks net of fees, which reduces asset growth. Reduced asset growth increases required employer contributions. Employers fund those contributions with tax revenue. Taxpayers unknowingly subsidize fee extraction and failed complexity

The report’s estimate—$59.1 billion since 2007—is not an abstract “missed opportunity.”

It is the present value of additional checks written by the State of New York, counties, cities, and school districts and their taxpayers.

Fees are often the dominant driver of net underperformance. The opposition report shows that in FY 2025 alone, Roughly 13% of employer contributions went directly to investment management fees to external managers, many of whom underperformed public markets

In other words, taxpayers paid fees first, and only then funded benefits. The DiNapoli Tax report aggregates costs that are typically hidden across multiple layers: Management fees, Performance fees (carried interest), Transaction and monitoring fees, Partnership expenses and Fund-of-fund fees.

Controller DiNapoli covers up the $59 billion Loss. Last week, New York State Comptroller Thomas DiNapoli rushed out a press release proclaiming that an “independent review” had cleared the New York State Common Retirement Fund (CRF) of ethical, fiduciary, and conflict-of-interest concerns. According to the Comptroller, the report proves that New York’s pension fund “operates at the highest ethical and professional standards.”

These so-called independent reviews collapse under even modest scrutiny. It never grapples with the central economic finding of the opposition report: $59 billion in avoidable taxpayer costs.

The reports DiNapoli cites are not independent in any meaningful fiduciary sense. They are procedural compliance audits, not economic fiduciary reviews. They examine whether boxes were checked—not whether retirees and taxpayers were harmed. The most recent review, conducted by Weaver & Tidwell LLP, explicitly states that it does not analyze investment performance, valuation accuracy, or economic outcomes. Instead, it limits itself to whether transactions complied with internal policies and DFS regulations, which are written by the Comptroller’s own office.

The Comptroller’s “independent” reviews repeatedly emphasize compliance with disclosure rules while never quantifying the economic impact of fees. A fund can be perfectly compliant—and still impose tens of billions in avoidable tax burden. That is exactly what the DiNapoli Tax report alleges. And it is exactly what the Comptroller refuses to confront.

A Benchmark Shell Game is used to hide these problems. New York relies on custom, non-investable benchmarks that flatter reported results while obscuring real economic performance. The Weaver report praises the Fund’s asset-allocation process but never evaluates whether those benchmarks are structurally biased in favor of private markets.

Compliance with a bad benchmark is not prudence; it is misdirection.

Valuation Risk is also ignored. The DiNapoli press release leans heavily on claims of “high transparency.” Yet the Weaver review accepts conflicted manager-provided NAVs at face value and explicitly disclaims any responsibility for testing valuation accuracy or loss recognition timing.

Why the DiNapoli Tax Report Matters — and Why You Haven’t Heard About It

The DiNapoli Tax report — a clear, dollar-denominated indictment of how underperformance in New York’s public pensions translates into higher taxes — should be front-page news. Instead, it’s barely registered outside a few niche outlets. Why? Because powerful private-equity interests have an interest in burying the story..

New York officials s since Citizens United have had the ability to receive secret dark money contributions from Private Equity. Politically connected and current MSNBC media darling, Steven Rattner. co-founded private-equity firm Quadrangle. Quadrangle became entangled in New York’s notorious pension pay-to-play scandal involving placement agents and political consultants around the State Comptroller’s office. Rattner/Quadrangle retained Hank Morris (a political consultant tied to the Comptroller) in a way regulators viewed as improper, with enforcement and settlement outcomes reported by major outlets. New York’s Attorney General also filed pleadings describing alleged misconduct in connection with the New York State Common Retirement Fund.

DealBook Nation is a good description of NY media. “DealBook” is shorthand not just for a New York Times newsletter, but for an entire elite finance media ecosystem centered in New York: with editors, reporters, conference stages, think-tank panels, cable-news green rooms, and carefully curated “thought leaders.” Private equity is not merely covered by this ecosystem; it is embedded within it.

The Comptroller is not just defending past actions. He is running for re-election—and expanding allocations to the very asset classes these reviews refuse to scrutinize.

Until New York commissions a real independent review that: Uses investable public benchmarks, Performs PME and cash-flow analysis, Independently audits private-asset valuations, and Quantifies dollar underperformance …claims of being “cleared” should be treated for what they are: whitewash, not accountability.

Pingback: New York Progressives Should Demand Jeffrey Epstein/Apollo Divestment from State and City Pensions- Leon Black & Marc Rowan | The CommonSense 401k Project