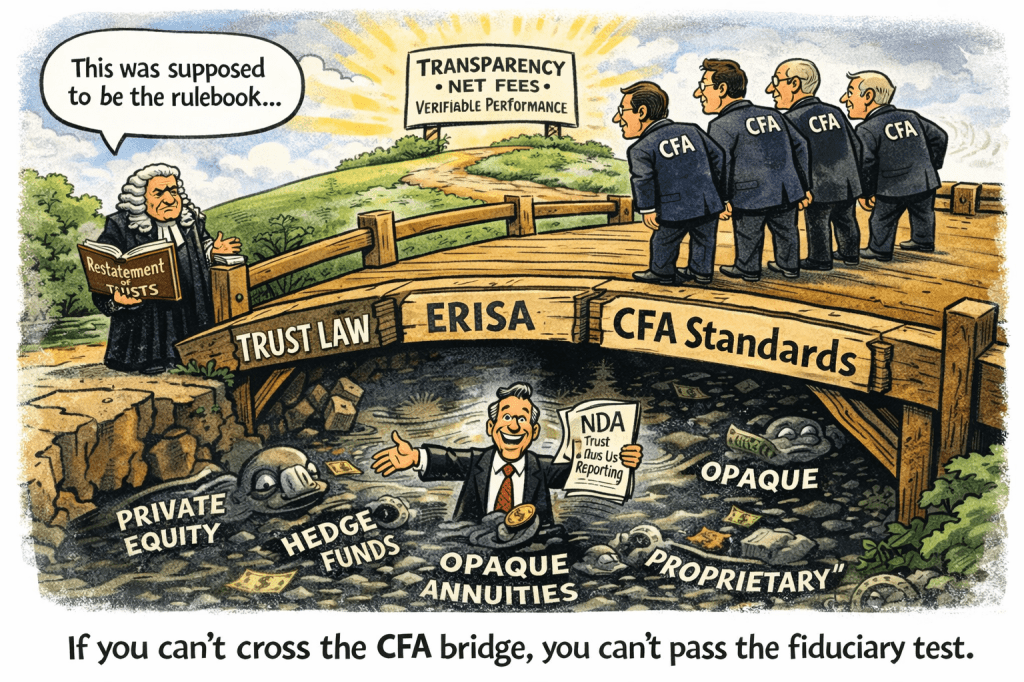

The bridge between Trust Law, ERISA, and what modern pensions forgot

When Congress wrote the Employee Retirement Income Security Act, they did not invent fiduciary duty.

They imported it from the Restatement (Second) of Trusts.

When the investment industry professionalized itself after the 1960s scandals, the CFA Institute did not invent fiduciary duty either.

They translated trust law into operational rules for investment professionals:

- Put the client first

- Disclose conflicts

- Present performance honestly

- Disclose fees fully

- Avoid structures you cannot explain

The CFA Code, GIPS, and the Asset Manager Code are not “best practices.”

They are trust law made practical. https://commonsense401kproject.com/2026/01/30/before-erisa-before-the-sec-there-was-trust-law/

Which is exactly why private equity, hedge funds, opaque annuities, and many modern pension structures cannot comply with them.

Not don’t comply.

Cannot comply.

Trust law asks one simple question

Can the beneficiary see what you are doing with their money?

CFA standards ask the same question in three ways:

| Trust Law | CFA Code | GIPS | Asset Manager Code |

| Duty of loyalty | Put client first | Net of all fees | Investors first |

| Duty to disclose | Conflicts disclosure | Verifiable performance | Full fee transparency |

| Duty of prudence | Fair dealing | Reproducible returns | No preferential treatment |

| Duty to inform | Honest communication | Independent valuation | Independent oversight |

If you can’t meet CFA standards, you can’t meet trust standards.

And if you can’t meet trust standards, you are violating the spirit of ERISA.

Why this is exploding now

Aannuites and private-equity and of course crypto show the same thing:

These products are engineered to sit outside:

- The Investment Company Act of 1940

- The trust-law spirit of ERISA

- The transparency discipline of CFA standards

That is not accidental.

GIPS requires:

- Reproducible performance

- Net-of-fee reporting including underlying fees

- Independent valuation

- Audit rights

Private equity contracts forbid those things.

Annuity contracts obscure those things.

You cannot be GIPS-compliant and run those structures the way they are run today.

The uncomfortable fact for CFA charterholders in pensions

Tens of thousands of CFA charterholders sign this every year:

“Place the integrity of the profession and the interests of clients above their own.”

Many public pensions are staffed and advised by CFA charterholders.

And yet they:

- Accept performance reporting that is not GIPS-reconstructible

- Accept contracts that waive fiduciary duty by general partners

- Accept fee structures that cannot be fully disclosed

- Participate in performance games that influence bonuses and narratives

This is not ignorance.

This is looking the other way.

Why CalPERS, Kentucky, Minnesota, and others all converge here

Kentucky literally wrote CFA standards into law in 1991 and again in 2017 — and then ignored them.

In Ted Siedle’s Minnesota work, you see the same structural problem without the CFA overlay:

- Opaque alternatives

- Governance conflicts

- Self-policing fiduciaries

- Performance that cannot be independently verified

CFA standards would expose both instantly, and will be featured in an upcoming CALPERS report I am assisting Ted Siedle on.

Because CFA standards were designed precisely to prevent:

- Cherry-picking

- Opaque valuations

- Hidden fees

- Self-dealing

- “Trust us” reporting

Why GIPS is the bright-line test

Look at the CFA GIPS firm list.

- BlackRock — listed

- JPMorgan Asset Management — listed

- Apollo Global Management — not listed

- KKR — not listed

- Carlyle Group — only liquid credit listed

- Blackstone — credit/insurance listed, not PE/real estate

That is not a coincidence.

Traditional managers can comply.

Private equity structures cannot.

The key insight

CFA standards are not aspirational ethics.

They are a functional test of whether an investment structure is compatible with fiduciary duty.

If a manager cannot meet them, a pension fiduciary should not be hiring them.

Period.

Why this ties directly back to trust law

A trust court would never allow:

- Secret contracts

- Manager-set valuations

- Hidden fees

- Preferential GP treatment

- Performance that cannot be independently verified

CFA standards say the same thing, in modern language.

ERISA says the same thing, in statutory language.

They are the same rulebook.

Why this matters now more than ever

Because modern legislation and regulatory trends increasingly say:

“As long as you document the process, it’s fine.”

Trust law and CFA standards say:

“If the structure itself prevents transparency, it’s not fine.”

That’s the clash happening in pensions today.

The blunt conclusion

If public pensions required and enforced:

- CFA Code adherence

- GIPS-compliant reporting

- Asset Manager Code compliance

Most hedge fund, private equity, opaque annuity, and alternative structures in public plans would disappear overnight.

Not because of politics.

Because they fail the fiduciary test that predates ERISA by centuries.

And that is exactly why CFA standards are needed now more than ever.