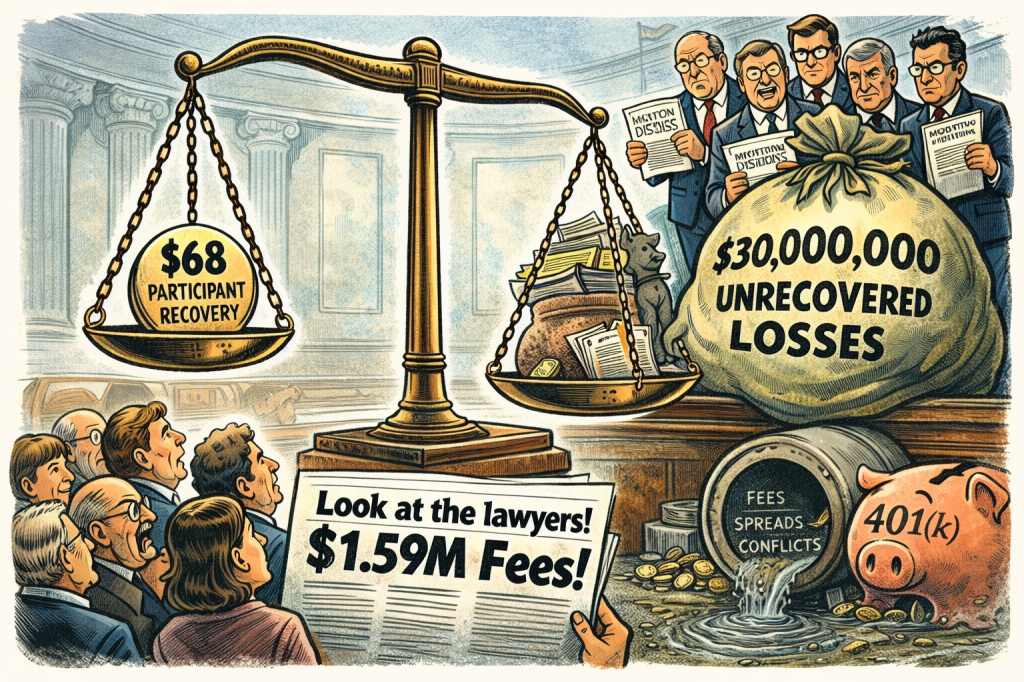

An industry piece from Plan Sponsor featuring a bogus study by industry lawyers is making the rounds with a tidy, outrage-ready statistic: https://www.planadviser.com/erisa-settlements-provided-68-per-plaintiff-in-2025/?utm_source=newsletter&utm_medium=email&utm_campaign=PAdash

“Median participant recovery: $67.79.

Average plaintiff attorney fee: $1.59 million.”

And the implied message is obvious:

“The real problem in 401(k) lawsuits is the lawyers, not the fiduciary misconduct.”

That framing is not just misleading.

It’s a defense narrative that flips the economics of ERISA litigation on their head.

Let’s do the math the article avoids.

What the settlement numbers actually say

Using the same figures being cited:

- Total settlements: $5.3 million per case

- Plaintiff fees: $1.59 million

- Participant recovery: $3.71 million

That means participants received 70% of the settlement dollars.

Not the lawyers.

Now the part no one mentions:

Those settlements typically represent 10–20% of the actual damages.

That’s not speculation. That’s how settlement economics work in these cases after years of motion practice, discovery fights, and judicial hostility at the pleading stage.

If $5.3 million is ~15% of actual damages, then:

Actual participant losses ≈ $35.3 million

That’s the real number. Wall Street Defense attorneys force the participants to take $3.71 million of the $35 million taken from them.

The number they don’t want you to see

As actual damages are roughly $35 million per case, then the hidden story is this:

Defense lawyers are helping fiduciaries settle cases for 15 cents on the dollar.

That’s about $30 million per plan in losses that never get repaid.

And the trade press wants you mad at the lawyers who took a third of the clawed back 15%.

Why settlements are so small relative to damages

Because courts increasingly:

- Dismiss cases before discovery,

- Demand “meaningful benchmarks” that don’t exist,

- Misapply standing rules,

- Treat revenue sharing and proprietary funds as normal,

- Block prohibited transaction claims at the pleading stage.

This forces plaintiff firms into a brutal risk calculus:

Take a discounted settlement now, or risk total dismissal later.

That is not a sign the cases lack merit.

That is a sign the legal environment is tilted.

The inversion

Here’s the real flow of money per case:

| Where the money goes | Approx. amount |

| Participant losses | $35,000,000 |

| Settlement paid | $5,300,000 |

| Participant recovery | $3,710,000 |

| Plaintiff attorneys | $1,590,000 |

| Unrecovered losses kept by fiduciary ecosystem | ~$30,000,000 |

And the headline focuses on the $1.59 million.

That’s the inversion.

Why this narrative exists

Because if the story were told honestly, it would read:

“401(k) fiduciaries and service providers avoided repaying $30 million per case thanks to procedural defenses and judicial pleading barriers.”

That’s not a comfortable story for an industry publication.

So instead, they write:

“Look how much the lawyers make.”

What this really shows

These cases are not evidence of plaintiff excess.

They are evidence of how hard it is to hold fiduciaries accountable under modern ERISA jurisprudence.

Despite:

- Documented fee disparities,

- Revenue sharing conflicts,

- Proprietary fund steering,

- Opaque CIT and annuity structures,

- Consultant conflicts,

Participants are recovering pennies on the dollar.

And the industry wants you to blame the only people who forced any recovery at all.

The uncomfortable truth

If plaintiff firms disappeared tomorrow, participants wouldn’t keep that $1.59 million.

They would lose the entire $35 million.

Because nothing else in the system is forcing fiduciaries to return money.

Not regulators.

Not consultants.

Not auditors.

Not recordkeepers.

Only litigation.

The punchline the industry hopes you miss

That $68 statistic is not proof lawsuits are broken.

It’s proof that:

Fiduciary breaches in 401(k) plans are so large, and recoveries so discounted, that even billions returned looks small when averaged out.

And the real scandal is not what the lawyers took.

It’s what the fiduciary ecosystem got to keep.