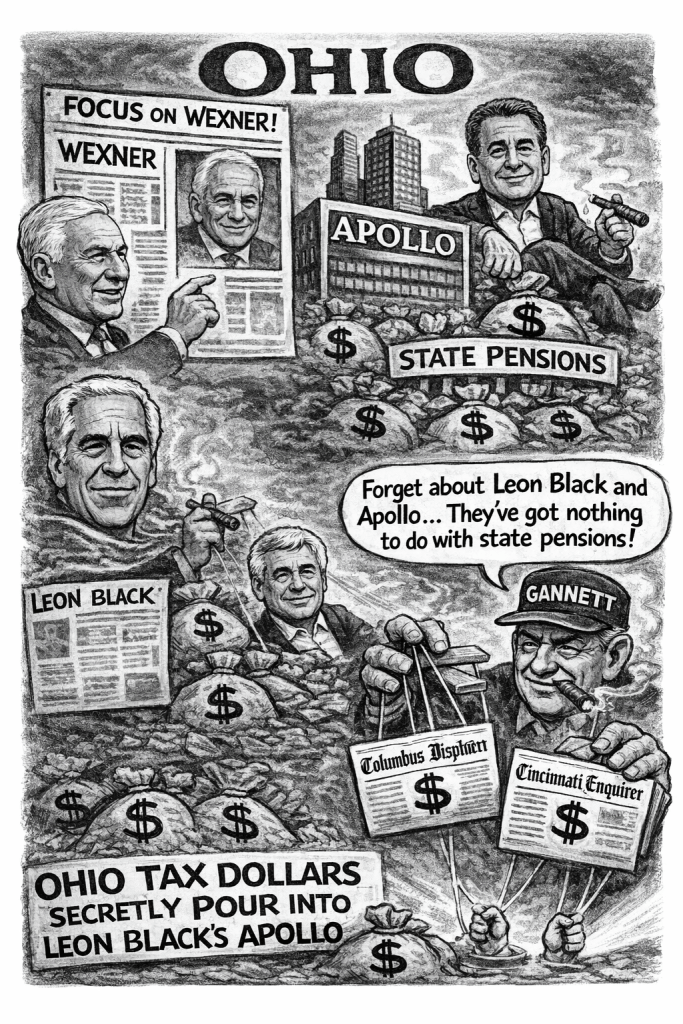

Yes, Les Wexner deserves scrutiny for his historic ties to Jeffrey Epstein. But while Ohio media fixates on Wexner, another name—Leon Black of Apollo Global Management—barely crosses the front page. That silence is not a coincidence. It’s a governance problem. While Lex Wexner provided a lot of seed money to Epstein, post his 2008 conviction Leon Blacks was his largest funder.

Because while Ohioans debate Wexner, Ohio taxpayers and teachers have paid hundreds of millions of dollars in fees and profit streams to Apollo through state pension investments—often via opaque, no-bid private market commitments buried in Alternative Investment schedules. And in 2026, new disclosures and calls for investigation from national labor and academic organizations have reopened questions that Ohio leaders can no longer pretend were settled in 2019. https://www.aft.org/press-release/aft-aaup-demand-sec-probe-over-apollo-execs-epstein-contacts

Wexner in the Headlines. Apollo in the Shadows.

It is widely reported that Leon Black paid Jeffrey Epstein more than $150 million over years—much of it after Epstein’s 2008 conviction. Those payments were characterized as tax and estate planning services. Internal reviews were conducted. Black stepped down. End of story, we were told.

But now the American Federation of Teachers (AFT) and American Association of University Professors (AAUP) are demanding a formal SEC probe into Apollo executives’ contacts with Epstein, citing newly disclosed documents and inconsistencies in prior representations. That is not gossip. That is a call for regulatory review.

And yet in Ohio, you would barely know this debate exists.

Why?

Ohio’s Pension Money and Apollo

Ohio’s major public retirement systems—including STRS Ohio, OPERS, and SERS and Highway Patrol—have invested repeatedly in Apollo-managed private equity and credit funds. These are typically structured as long-term, illiquid partnerships:

- No public bidding process

- Limited disclosure of underlying portfolio holdings

- Confidential fee structures

- Limited transparency into side letters and GP economics

In other words: perfect vehicles for taxpayers to be exposed to governance risk without knowing it.

If Ohio pensions have committed capital across multiple Apollo vintages—as publicly available alternative investment schedules suggest—then Ohio educators, firefighters, and taxpayers are not peripheral observers in the Apollo story. They are participants.

And here’s the uncomfortable extension: The Ohio State University endowment also participates in private markets. If Apollo exposures exist there as well, that would mean Ohio’s flagship university is financially tied to a firm still defending its executive contacts with Epstein.

That is not guilt by association. That is fiduciary exposure.

The Lifetouch Question

Apollo is not merely a Wall Street fund manager. It owns operating businesses—including Lifetouch, the school photography company that collects millions of children’s photos across America.

When a firm that profits from public pensions and owns companies interacting with children is simultaneously tied to executives who maintained contact with a convicted sex offender, fiduciaries do not get to shrug and say, “That’s someone else’s problem.”

It becomes a governance issue.

The Media Conflict Ohio Won’t Discuss

Here’s the deeper structural problem.

The Columbus Dispatch and the Cincinnati Enquirer are owned by Gannett. Gannett has been financed and supported by private equity structures tied to Apollo in past transactions. Whether through direct financing arrangements or broader capital structure ties, Apollo has had material involvement in Gannett’s financial ecosystem. https://commonsense401kproject.com/2025/08/22/ohio-medias-complicity-how-a-fake-scandal-hid-the-real-teacher-retirement-system-corruption/

That means the two largest Ohio newspapers covering state pensions are financially connected—directly or indirectly—to a firm profiting from those pensions. Only the Toledo Blade has given accurate coverage.

Even if no editor is ever told what to write, the conflict is obvious:

- Apollo profits from Ohio pensions.

- Apollo is tied to executives under renewed Epstein scrutiny.

- Ohio’s major newspapers have financial relationships within Apollo’s orbit.

Ohioans deserve to ask: Who investigates the investigator when the newsroom is financially intertwined with the subject?

STRS Ohio: Will Trustees Demand Divestment?

This is where it becomes specific—and urgent.

At STRS Ohio, trustee battles have already exposed deep governance divides. AFT- and AAUP-affiliated trustees have historically clashed with gubernatorial appointees. Most recently, Ohio’s Attorney General’s office attacked AAUP representative Rudy Fichtenbaum in board disputes tied to investment transparency and governance reform.

Now that AFT and AAUP nationally have called for an SEC probe into Apollo over Epstein contacts, Ohio’s affiliated trustees face a simple question:

Will they call for Apollo divestment or at least a formal re-underwriting review?

If not, why not?

If so, will Ohio’s political leadership allow that debate—or suppress it?

Ohio Leaders Cannot Pretend This Is 2019

In 2019, many pensions declined to divest from Apollo, citing internal reviews and assurances. But new disclosures and external regulatory pressure change the fiduciary calculus.

Divestment is not about punishment. It is about:

- Reassessing reputational risk

- Evaluating disclosure integrity

- Re-examining prior reliance on GP statements

- Protecting beneficiaries from governance contagion

The duty of loyalty does not end when headlines fade.

The Hard Questions for Ohio

- How much capital—current NAV and unfunded commitments—does each Ohio pension have invested with Apollo?

- What total fees (management + carried interest + transaction fees) have been paid to Apollo since 2007?

- Were any of those commitments made without competitive bidding?

- Has STRS or OPERS re-evaluated Apollo exposure since the 2026 AFT/AAUP letter?

- Do any Ohio public institutions—including OSU—have Apollo exposures?

- Will trustees request executive-session briefings specifically on Apollo’s Epstein-related disclosures?

If those answers are not publicly available, that is precisely the problem.

Ohio’s Pattern of Silence

In prior Commonsense investigations, we documented how Ohio media diverted attention toward manufactured scandals while avoiding deeper structural pension issues. We saw how executive compensation ballooned while teachers bore the cost. We saw how governance critics were attacked rather than answered. While the pension scandal dwarfs that of First Energy, the culture of corruption in government and media has kept it under wraps

Now, as national attention turns again to Epstein-linked financial networks, Ohio risks repeating the same mistake: focusing on the name that dominates headlines while ignoring the one still writing checks from public pension capital.