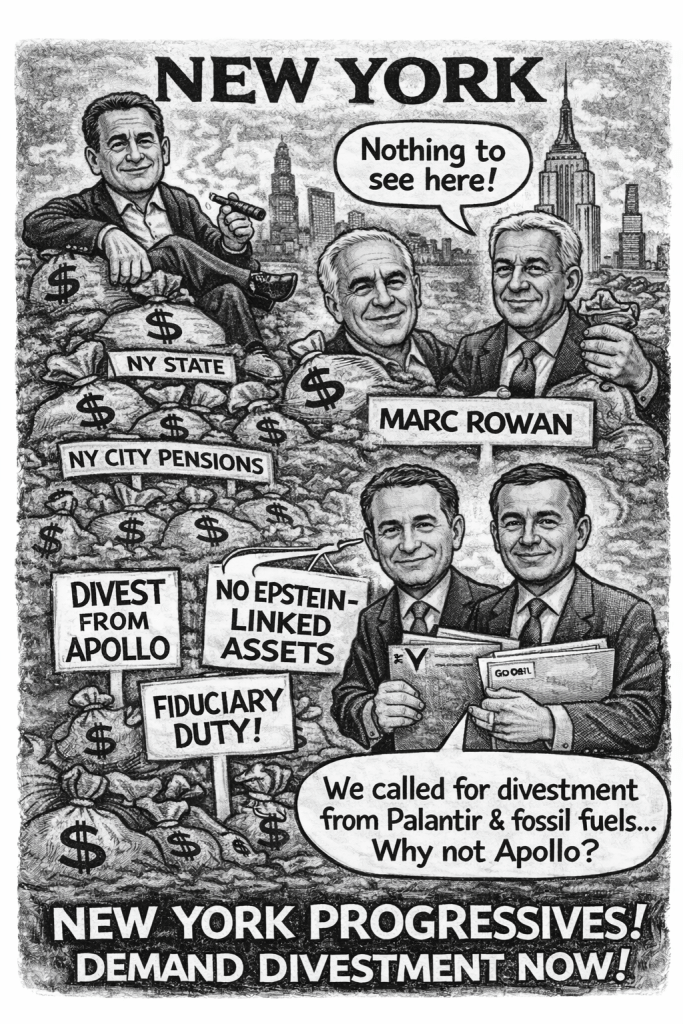

New York progressives have never been shy about demanding that public pensions align with public values. They have pushed divestment from fossil fuels.

They have called out Palantir. They have criticized excessive private equity fees. They have criticized investments linked to genocide in Gaza

Why is Apollo Global Management still deeply embedded in New York’s public pensions? They are worst of worst

And why has there been no serious divestment debate in Albany or City Hall, despite renewed scrutiny of Apollo’s leadership over their documented ties to Jeffrey Epstein? New and disturbing information on pedophile issues around Leon Black and ownership of school photo firm Lifetouch are in the news daily.

The Money Is Not Small

New York’s exposure to Apollo is not theoretical. It is massive and multi-vintage. Near $1 billion

According to New York State Common Retirement Fund (NYSCRF) reports and transaction disclosures:

- August 2013 — Apollo Investment Fund VIII, L.P.

$400 million commitment - 2015 (report dated August 2015) — Apollo Natural Resources II, L.P.

$400 million commitment - December 2021 — Apollo Impact Mission Fund

$150 million commitment

(Monthly report describes Apollo as an “existing relationship”) - December 2022 — Apollo Investment Fund X, L.P.

$350 million commitment - March 2023 — Apollo Excelsior PE Co-Invest, L.P.

$350 million commitment - https://commonsense401kproject.com/2026/02/05/the-apollo-epstein-files-why-public-pensions-should-reopen-the-2019-divestment-debate/

New York City pensions—including the Teachers’ Retirement System (TRS NYC)—have also been reported to have commitments to Apollo funds.

This is not a legacy relationship winding down.

It is active, expanding, and ongoing.

The Epstein Question Is Not Going Away

Leon Black paid Jeffrey Epstein more than $150 million over years, including after Epstein’s 2008 conviction. Marc Rowan and other Apollo executives have faced renewed scrutiny following document releases and calls from national organizations for regulatory review. As reported in FT, Marc Rowan lied or at best, misled public pensions on the extent of their involvement with Jeffrey Epstein.

The American Federation of Teachers (AFT) and American Association of University Professors (AAUP) have formally urged the SEC to investigate disclosures relating to Apollo executives’ contacts with Epstein. https://www.aft.org/press-release/aft-aaup-demand-sec-probe-over-apollo-execs-epstein-contacts Hopefully, this will lead to their member trustees calling for divestment nationwide.

New York is home to some of the most progressive pension governance rhetoric in the country. Yet there has been no sustained demand that:

- NY Stat re-underwrites its Apollo relationship

- NYC pensions conduct a public governance review

- Trustees disclose how reputational risk is assessed

The $59 Billion Fee Problem

- New York pensions have already been criticized for excessive private equity fee leakage—what has been described as $59 billion in excessive costs over time through opaque private markets structures. https://commonsense401kproject.com/2026/01/18/ny-pension-called-out-for-59-billion-in-excessive-fees/

Progressives regularly argue that private equity extracts wealth from workers and communities.

Apollo is one of the largest beneficiaries of that structure.

If New York believes private equity fees function as a hidden tax on retirees, then the firm receiving hundreds of millions in commitments deserves enhanced scrutiny—not immunity.

Marc Rowan’s Expanding Political Role

Besides Epstein ties Marc Rowan’s reported appointment to a Trump-era Gaza advisory board adds a geopolitical dimension that many progressive voters will find troubling. Most progressives oppose the Genocide in Gaza, so this should be especially disturbing.

Public pensions must consider not only financial performance but governance risk, reputational exposure, and political entanglement.

Comptroller Candidates Have Already Set the Standard

Comptroller candidates Drew Warshaw and Raj Goyle have already called for:

- Divestment from Palantir

- Divestment from fossil fuels

- Reduction of excessive private equity fees

Apollo Global Management is the largest private equity owner of hospitals in the United States, controlling approximately 220 facilities across 36 states through Lifepoint Health and ScionHealth Senate investigators found that Apollo holds a 97% ownership stake in Lifepoint, which pays Apollo $9.2 million annually in management fees and has paid substantial transaction fees, including a $55 million fee tied to a major acquisition These payments occurred while Apollo-owned hospitals faced service cuts, staffing reductions, declining patient satisfaction, and failure to meet legally binding capital expenditure commitments

Public Citizen and the Private Equity Stakeholder Project identify Apollo among private equity firms backing oil and gas companies drilling on federal lands since 2017, with inadequate bonding to cover potential cleanup liabilities. The report estimates that private equity-backed drillers could leave taxpayers exposed to hundreds of millions of dollars in environmental remediation costs, as bonding requirements cover only a small fraction of potential cleanup obligations

The Fiduciary Standard Cuts Both Ways

This is not a call for performative politics. It is a call for fiduciary consistency.

A proper review would require:

- Public disclosure of total exposure to Apollo across all NY state and city plans

- A formal board discussion of reputational and governance risk

- Review of all side letters and fee structures

- Independent counsel analysis of whether prior disclosures relied upon by trustees remain accurate in light of newly surfaced information

If the conclusion after such review is to maintain the relationship, so be it. But silence is not prudence.

The Political Reality

New York prides itself on progressive pension leadership. Yet Apollo continues to receive fresh commitments—Fund X in 2022, co-investments in 2023—while national headlines about executive ties to Epstein resurface. The question for Albany and City Hall is straightforward: Are New York pensions governed by values and transparency—

or by inertia and access?