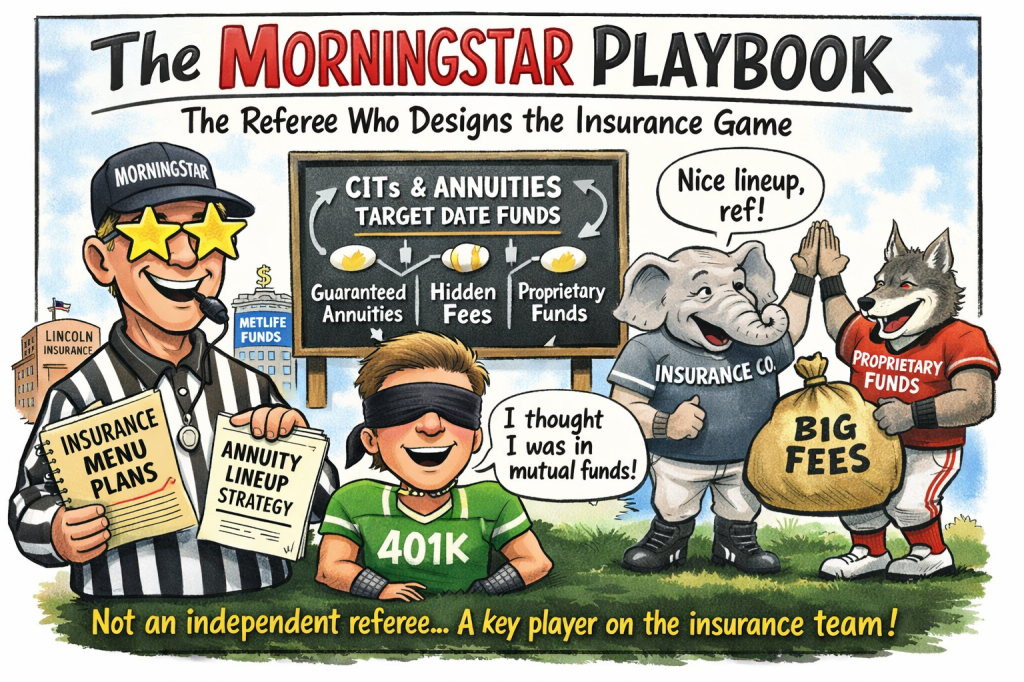

For years, Morningstar has positioned itself as the independent umpire of the mutual fund world.

The star ratings. The analyst reports. The fiduciary consulting.

If Morningstar approves it, fiduciaries feel safe.

But buried in Morningstar’s own SEC filings is something most plan sponsors, consultants, and courts do not realize:

Morningstar is deeply embedded in the business of helping insurance companies design retirement plan investment menus built around CITs, annuities, and proprietary insurance wrappers — the very structures now raising ERISA prohibited transaction concerns.

This isn’t speculation. It’s in their Form ADV.

Morningstar Retirement: Not What People Think

Morningstar Investment Management’s “Retirement” division does not simply analyze mutual funds.

They explicitly say they: “construct custom model portfolios for employer-sponsored retirement plans using the investment options available in a plan’s lineup.”

That sounds harmless — until you read the next sentence: “The universe of underlying holdings is generally defined by the Institutional Client and can include investment products that are affiliated with that Institutional Client.”

Translation: If Lincoln, MetLife, TIAA, Principal, Empower, or an insurance platform defines the menu, Morningstar builds portfolios using those proprietary insurance products.

They are not evaluating an open market of mutual funds. They are working inside insurer-defined universes.

The MetLife Smoking Gun

Morningstar has a dedicated ADV brochure for: “Advisory Services to MetLife ExpertSelect Program”

In this document, Morningstar openly states:

“We selected the menu of investment options available in the MetLife ExpertSelect Program from the universe of investments that MetLife is authorized to offer.”

They go further: “We do not review the annuity products in connection with the Program.”

Read that again. Morningstar — the supposed fiduciary expert — builds the menu but does not review the annuity products.

They also state: “The lineups we build are limited to a universe of mutual funds and other investment vehicles, such as CITs and guaranteed retirement income products such as annuities.”

So Morningstar’s job here is: Make insurance menus look like diversified retirement lineups.

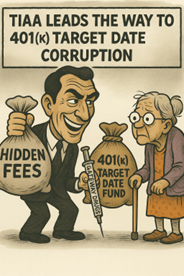

The Target Date Angle Nobody Talks About

Morningstar also offers:

“Personal Target Date Fund Services” “Custom Model Portfolios” “3(21) and 3(38) fiduciary services”

But those services are constrained to: “the investment options available in the plan lineup.”

And those lineups, in insurance platforms, are:

- CITs

- Stable value

- Separate accounts

- Annuity sleeves

- Proprietary trust wrappers

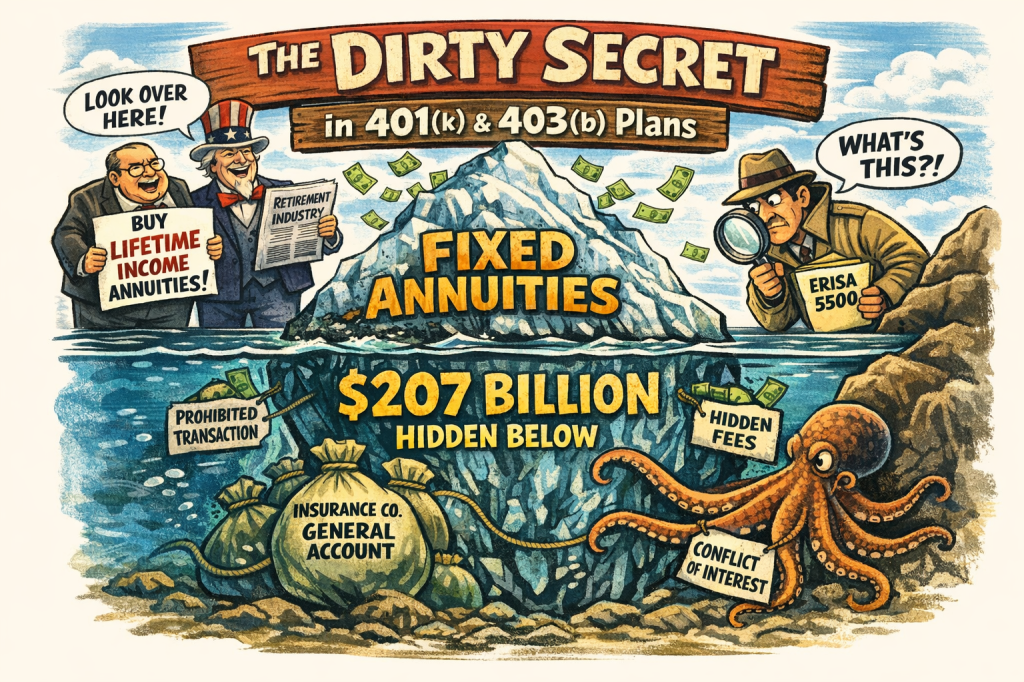

This is exactly the structure now showing up in TIAA, Lincoln, MetLife, and other insurance-based target date designs where:

The participant thinks they are in mutual funds, But they are inside insurance contracts.

Morningstar is often the firm paid to “monitor” and “approve” these lineups.

And Morningstar Gets Paid Very Well For This

Their fee schedules show:

- 2–15 basis points for institutional asset management

- 3–8 bps for fiduciary services

- Minimums of $100,000 to $450,000

- Special target-date and managed account fees

This is a huge revenue business tied directly to insurer retirement platforms.

They even disclose: “We receive direct or indirect cash payments from unaffiliated third parties for referring their services to other advisory firms or investors.”

And: “We provide compensation to Institutional Clients to provide marketing or educational support…”

This is not a passive ratings agency. This is an active participant in the insurance retirement ecosystem.

Why Their Articles Read the Way They Do

When Morningstar writes articles like:

- “The hidden trend changing 401(k) plans”

- “Target date fund trends”

They present the rise of CITs and insurance-based structures as innovation.

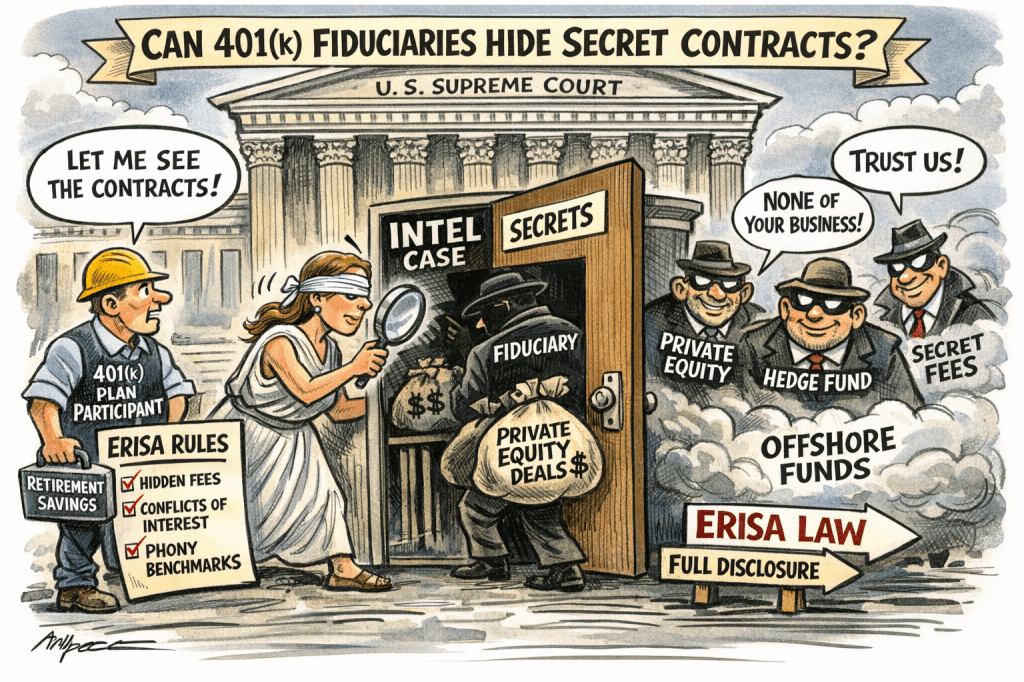

They never mention:

- Prohibited transaction risk

- Party-in-interest issues

- Share class access problems

- Insurance wrapper conflicts

- Hidden spread compensation

- Fiduciary benchmarking problems

Because this is the ecosystem they are paid to support.

https://www.morningstar.com/funds/hidden-trend-is-changing-401k-plans-heres-what-it-means-investors

https://401kspecialistmag.com/target-date-fund-trends-morningstar/

The Fiduciary Illusion

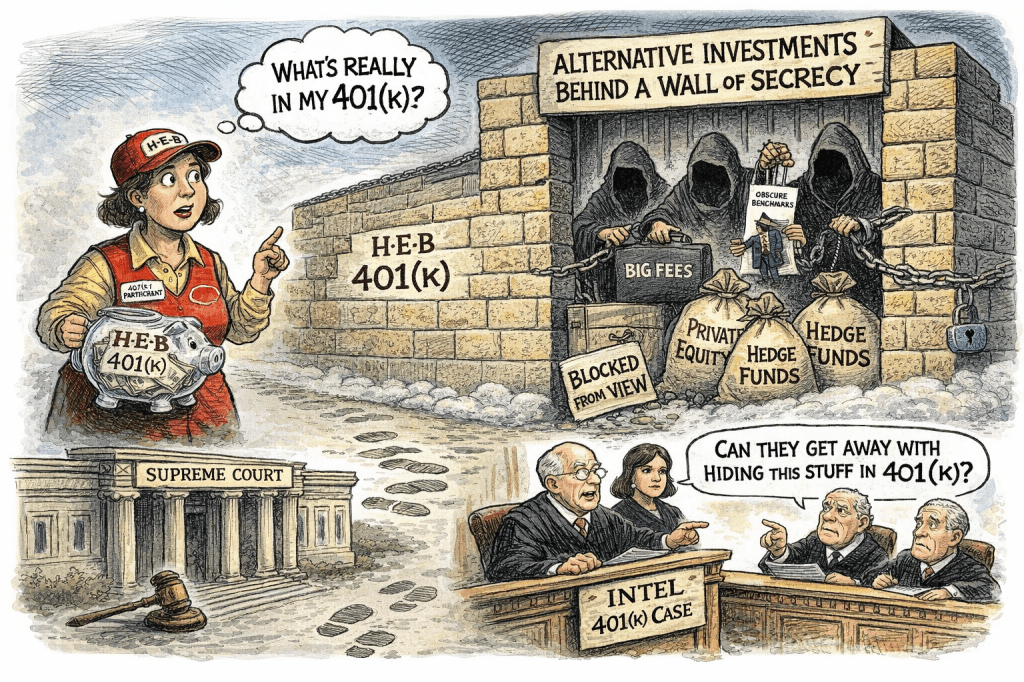

Plan sponsors believe:

“Morningstar is monitoring our funds.”

What Morningstar is actually doing in many insurance platforms is:

Monitoring the funds inside the insurance cage.

They are not asking:

Why are we in the cage at all?

The Real Question Fiduciaries Should Ask

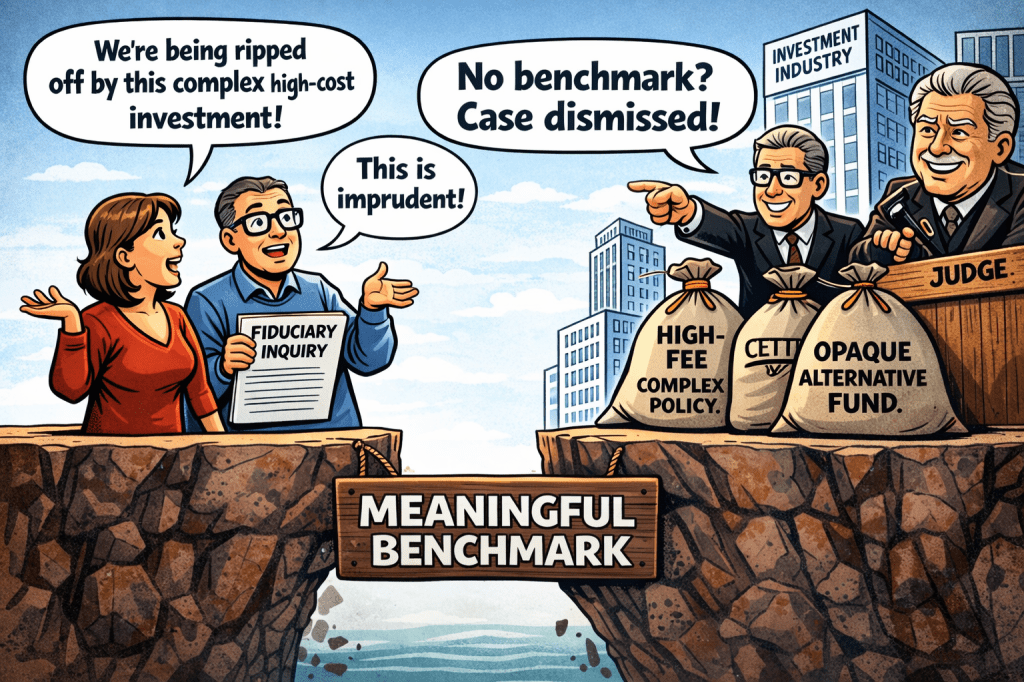

When Morningstar is hired in a Lincoln, MetLife, TIAA, or similar platform, the right question is:

Are they acting as an independent fiduciary reviewer?

Or Are they being paid to make an insurance menu look prudent?

Because their own ADV says the latter.

The Bottom Line

Morningstar is no longer just the referee of the mutual fund world.

They are now a key architect of insurance-based retirement plan menus where:

- CITs replace mutual funds

- Annuities hide inside target dates

- Proprietary wrappers block institutional pricing

- Fiduciary conflicts multiply

And they disclose it all — if you read the fine print.

Most fiduciaries never do.

Appendix: Morningstar’s Dual Role — Ratings Provider and Insurance Scorekeeper

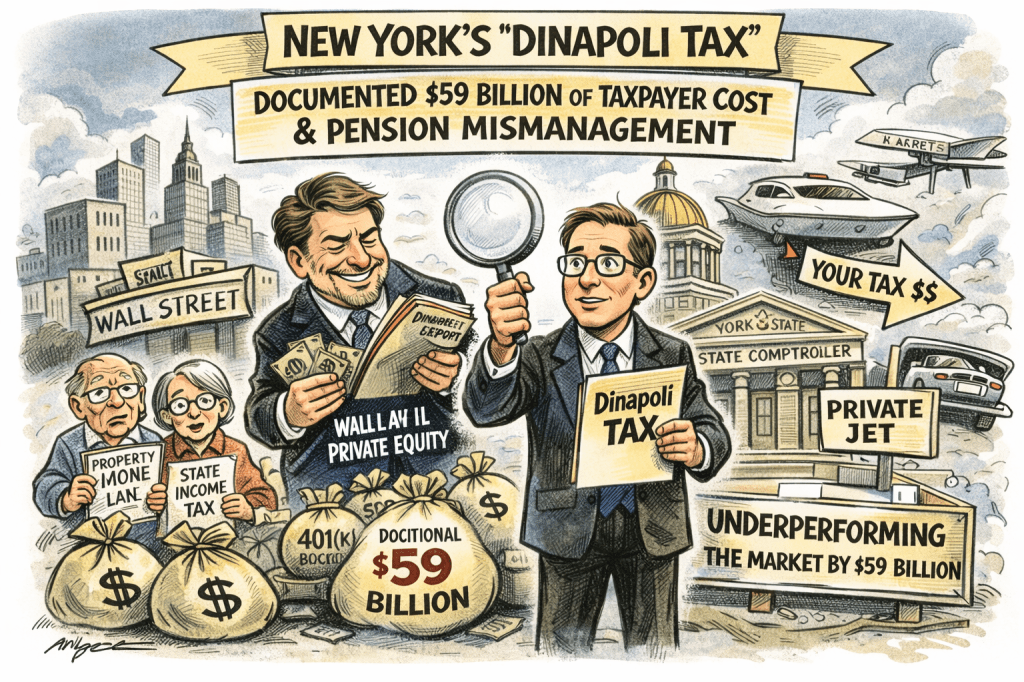

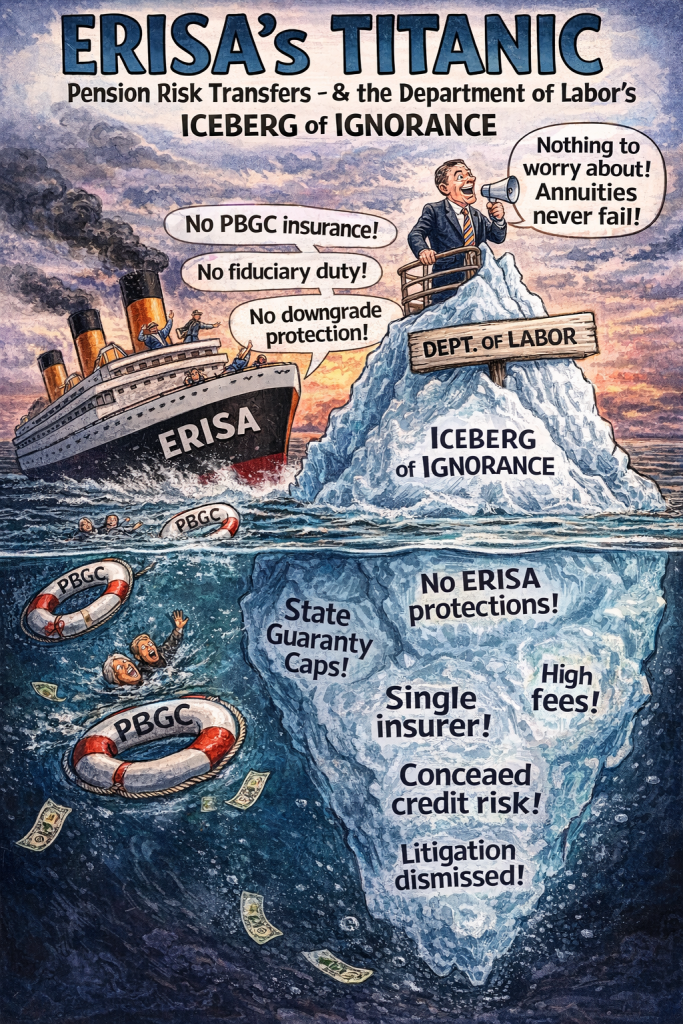

While the main article above documented how Morningstar serves as a referee, scorer, and evaluator for the insurance industry — especially in distributing and marketing annuity products — there is a parallel role that is even more consequential for pension risk transfers and fiduciary decision-making: Morningstar’s participation on the credit-rating side of private insurance-backed securities.

1. Morningstar Is Now a Major Player in Privately Rated Securities

Life insurers have shifted a growing share of their portfolio into privately placed debt, direct lending, and private credit — assets that are not traded publicly and for which there is no market price discovery. To make these assets look “investment grade,” insurers increasingly rely on private letter ratings (PLRs) — credit opinions issued by small, non-S&P/Moody’s rating firms.

Among the few firms active in this market is Morningstar DBRS — the credit rating arm of Morningstar that issues private ratings on securities typically held by insurance companies or structured finance vehicles.

According to industry data, as of year-end 2023, approximately 86% of U.S. insurers’ privately rated securities were rated by small CRPs including Morningstar DBRS. The result is that a large portion of the so-called “investment grade” portfolio backing life annuities is not rated by the major public agencies at all, but by niche providers whose methodologies and transparency are not subject to broad market scrutiny.

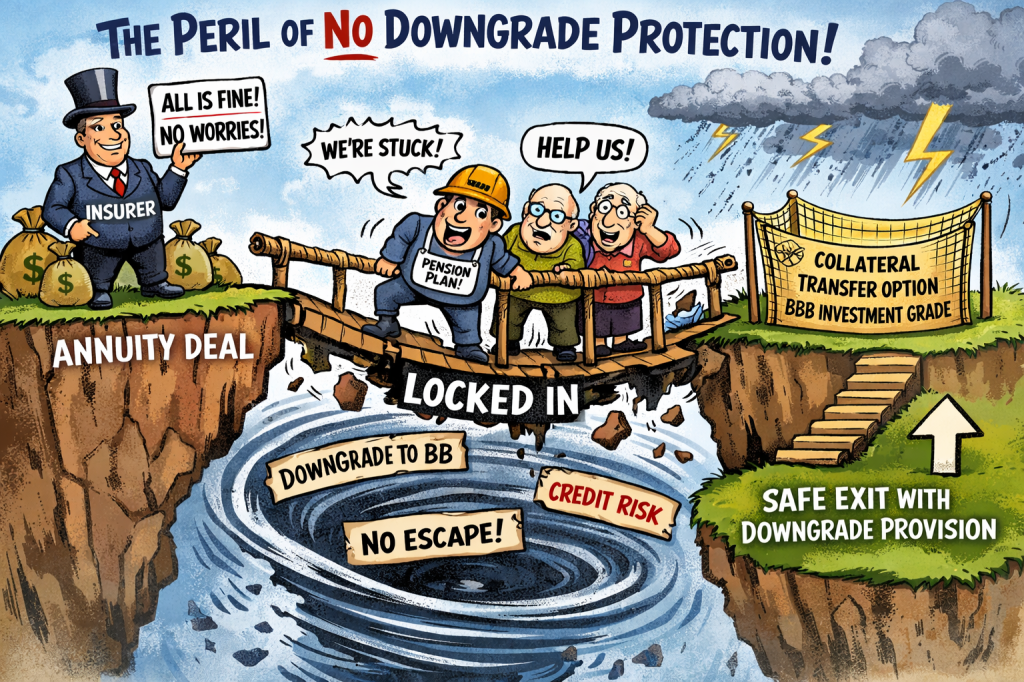

2. The Conflicted Incentives of Private Letter Ratings

Private letter ratings are fundamentally different from public credit ratings:

- They are paid for by the issuer or sponsor, not by market subscribers.

- They apply to securities that have no public trading market.

- Their output cannot be independently verified by investors or fiduciaries.

- Their methodology disclosures are limited or proprietary.

When Morningstar DBRS assigns an investment-grade letter to a privately placed life-insurer bond or private credit tranche, that rating becomes part of the narrative insurers use to declare that “over 90% of our portfolio is investment grade.” In other words, Morningstar’s rating opinion gets rolled up into insurer marketing and fiduciary disclosures, even though the underlying assets may be opaque, illiquid, and of uncertain credit quality.

This raises an obvious question:

Should a ratings arm of a firm that also earns fees from insurers for scoring insurance products be treated as independent when it privately rates securities sold to those same insurers?

3. Egan-Jones, SEC Scrutiny, and Why It Matters Here

The financial press has reported that the SEC is investigating Egan-Jones for its rating practices, raising concerns about whether private CRPs are applying appropriate standards or simply rubber-stamping risk. (See: “Egan-Jones Probed by SEC Over Its Credit Ratings Practices,” Financial Advisor Magazine.)

Morningstar’s credit arm has not been the subject of the same public regulatory scrutiny — but the structural problem is the same:

A firm with revenue streams tied to the insurance ecosystem is issuing “investment grade” opinions on assets that lack public market validation.

That is neither transparent nor consistent with the way public credit ratings are expected to function in capital markets.

4. PLRs Populate Annuity Backing Portfolios With Unknown Risk

Even if regulators decide to restrict or ban private letter ratings going forward, that would only affect new ratings. It would not address the estimated $1.6–$1.8 trillion of private credit already on U.S. life insurers’ balance sheets — much of it rated privately by firms such as Morningstar DBRS.

Because these assets:

- Are illiquid,

- Are not publicly traded,

- Do not have transparent pricing, and

- Are often backed by non-bankruptcy-remote structures or reinsurance vehicles,

their credit quality cannot be independently confirmed. The only basis for believing they are investment grade is the letter assigned by a small CRP.

That dynamic helps explain why widely followed market indicators such as credit default swap (CDS) spreads for large life insurers often show persistent credit risk that does not align with the high investment-grade ratings insurers tout. (See your October 29 article on annuity risk as measured by CDS.)

5. Morningstar’s Dual Roles Create a Perverse Incentive Loop

Morningstar:

- Scores insurance products (e.g., annuities) for platforms and distributors,

- Rates peripheral securities held by insurance companies, and

- Participates in data and analytics ecosystems that insurers and fiduciaries use for decision-making.

This combination raises two systemic concerns:

A. Conflicts of Interest — When an insurance-industry scoring provider also issues credit ratings for instruments used to back those same products, there is a risk that independence is compromised — or at least perceived to be.

B. Lack of Market Discipline — Because private letter ratings are not subject to public market verification, they allow insurers to present opaque risk as “safe,” undermining the ability of fiduciaries to evaluate risk meaningfully.

Conclusion: Ratings Matter — Especially When They Don’t Match Reality

Your main article argues that Morningstar helps design the insurance playbook. This appendix shows a darker side of how that playbook is supported: by obscuring underlying asset risk with opaque ratings.

In a world where:

- General account assets are increasingly private credit,

- CDS spreads suggest elevated insurer risk,

- PBGC backstops are disappearing after PRTs,

- And fiduciaries are told to rely on “investment grade” labels,

it is no longer acceptable to treat privately rated credit as equivalent to S&P/Moody’s investment grade.

ERISA fiduciaries, regulators, and courts need to recognize that:

A rating is only as good as the transparency, independence, and accountability behind it.

If the referee is also the designer of the playbook, and also rates the teams, then the game is not being called fairly — and retirees are the ones on the field with no protection.

https://www.fa-mag.com/news/egan-jones-probed-by-sec-over-its-credit-ratings-practices-84762.html

https://www.insurancejournal.com/news/international/2026/01/23/855368.htm. https://commonsense401kproject.com/2025/10/29/annuity-risk-measured-by-credit-default-swaps-cds/