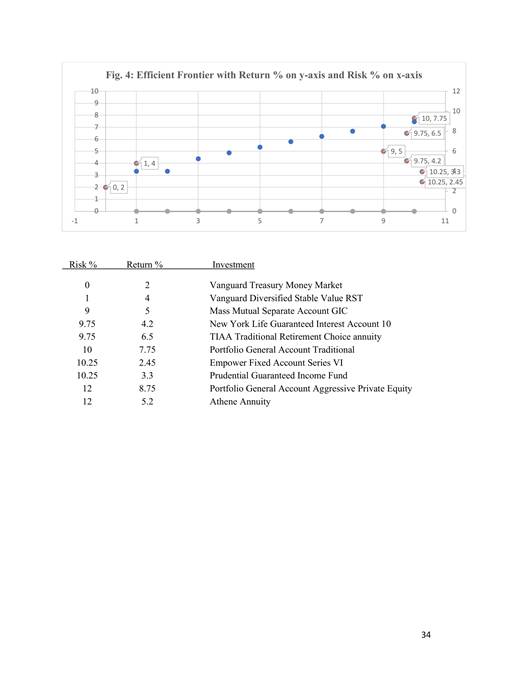

Professor Thomas Lambert (University of Louisville) and I wrote a paper accepted by the Journal of Economic Issues: “Safe” Annuity Retirement Products and a Possible U.S. Retirement Crisis (https://ir.library.louisville.edu/faculty/943/). One of the central contributions of the paper is a simple chart — the risk–return efficient frontier for stable value funds and annuities. For the first time, we plotted these so-called “safe” retirement products on the same terms that investment managers use to evaluate mutual funds and stocks. The results are eye-opening.

The Chart

What It Shows

– Risk (x-axis): Diversified pooled products like Vanguard RST or the Hueler stable value universe sit at the low-risk end. By contrast, single-entity general account annuities (Prudential, Athene, Lincoln, etc.) fall far to the right. Actuarial evidence (Griffin, Fabozzi Handbook of Stable Value, 1998) confirms they carry ten times the risk of diversified stable value.

– Return (y-axis): Crediting rates. TIAA and the TSP G Fund are transparent; most other insurers are not. They vary rates from client to client — not by size or efficiency, but by what they think they can get away with.

Why Distances Matter

– Vertical gaps = lost earnings. Example: Valley’s plan chose Lincoln at 2.05% while peers like TIAA and MassMutual pay 4–6%. That’s measurable damages, compounded over years.

– Horizontal gaps = reckless risk. Two products may credit the same rate, but one carries ten times the credit risk. That is fiduciary malpractice.

– Distance from the efficient frontier = fiduciary breach. If a product is dominated (worse risk and worse return than available alternatives), fiduciaries cannot justify keeping it.

Why This Matters

– For participants: The “safe” annuity in your plan may actually be the riskiest product you own.

– For fiduciaries: This chart is a one-page prudence test. If your plan’s dot sits below the frontier, you are failing participants.

– For courts: Juries and judges understand pictures. The vertical drop equals lost earnings, the damages owed.

-General Account portfolio returns are estimated on the graph because even the highest yielding fixed annuity, like TIAA, still has excessive spreads of around 150 basis points.

The Transparency Problem

Outside of TIAA and the TSP G Fund, insurer rates are hidden. Consultants quietly sell access to FI360 or Hueler data, but participants can’t see what they’re earning. That opacity masks insurer spread profits and keeps fiduciaries blind.

Bottom Line

Stable value and pooled products sit on the efficient frontier. Most fixed annuities don’t. The distances between the dots aren’t abstract — they are the measure of fiduciary failure, and the dollar value of retirement savings lost.

Journal of Economic Issues Accepted 2024 Thomas E. Lambert University of Louisville, Christopher B. Tobe , ““Safe” Annuity Retirement Products and a Possible U.S. Retirement Crisis,” https://ir.library.louisville.edu/faculty/943/

The Handbook of Stable Value Investments 1st Edition by Frank J. Fabozzi 1998 Jacquelin Griffin Evaluating Wrap Provider Credit Risk in Synthetic GICs pg. 272 https://www.amazon.com/Handbook-Stable-Value-Investments/dp/1883249422

Well done! Yet another example of plan sponsors unnecessarily exposing themselves to fiduciary liability by not understanding a product and actually hurting employees by drinking the annuity industry’s Kool-aid

Yahoo Mail: Search, Organize, Conquer

LikeLike