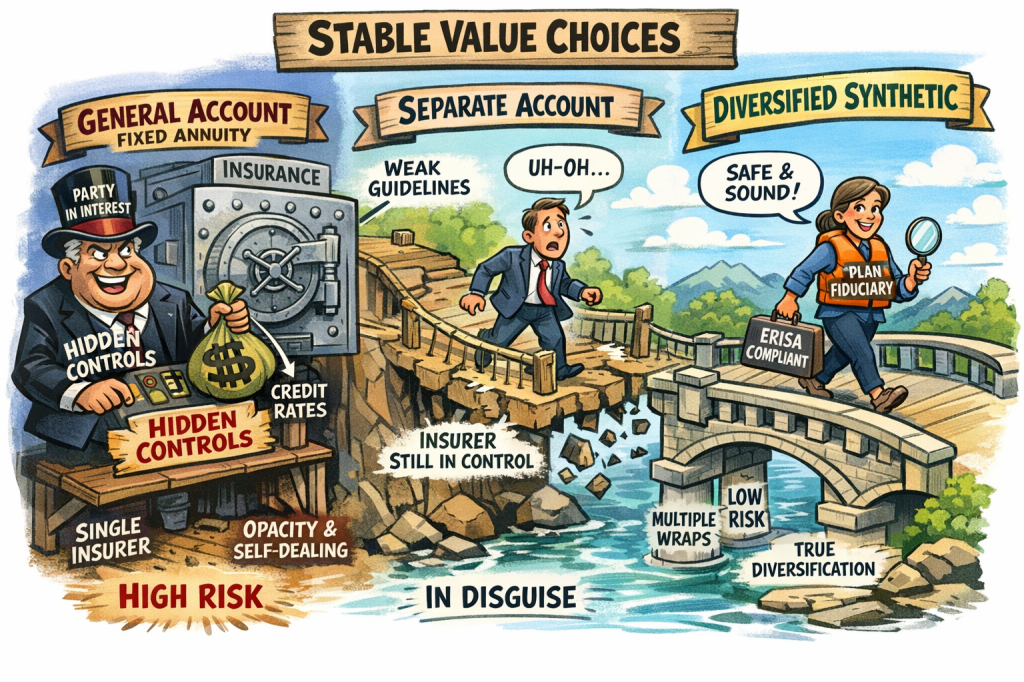

For more than 30 years, “stable value” has been marketed to retirement plan fiduciaries as a conservative, low-risk, bond-like option. That description is only accurate for one form of stable value: diversified synthetic stable value.

General Account (GA) and Separate Account (SA) stable value products are fundamentally different. They embed insurance spread products, opaque crediting decisions, and conflicted compensation structures that directly collide with ERISA’s duties of loyalty, prudence, and prohibited-transaction rules.

This distinction is not academic. It is measurable, documented, and long recognized in the academic literature.

I. The Academic Baseline: General Account Risk Is an Order of Magnitude Higher

In The Handbook of Stable Value Investments (Frank J. Fabozzi, ed., 1998), Jacqueline Griffin’s chapter on wrap provider credit risk demonstrates that general account stable value products carry roughly ten times the credit risk of diversified synthetic GIC structures. https://www.amazon.com/Handbook-Stable-Value-Investments/dp/1883249422

Why?

Because in a general account product:

- Participants are exposed to the entire insurer balance sheet

- Assets are commingled with unrelated insurance liabilities

- Returns are driven by insurer spread management, not portfolio performance

- Risk is single-entity, undiversified credit risk

Synthetic structures, by contrast, isolate risk, diversify exposure, and enforce constraints.

This is not a matter of opinion. It is structural.

II. What Makes Synthetic Stable Value Fundamentally Different

Diversified synthetic stable value is not an insurance product. It is a bond portfolio plus third-party guarantees.

Its defining features are:

1. Enforced investment guidelines

- Duration limits

- Credit quality floors

- Sector concentration caps

- Prohibited asset classes

These guidelines are contractual and enforceable, not aspirational.

2. Independent wrap providers

- Multiple, unrelated wrap issuers

- Diversified counterparty exposure

- No dependence on a single insurer’s solvency

3. Transparent crediting-rate formulas

- Crediting rates are formula-driven

- Inputs are observable: yield, duration, market-to-book ratio

- No discretionary “pricing committee” authority

4. No embedded spread product

- No insurer decides how much return to “pass through”

- No opaque profit margin extracted from participant balances

This structure aligns cleanly with ERISA fiduciary principles:

- Diversification

- Transparency

- Process discipline

- Arm’s-length pricing

That is why synthetic stable value does not raise inherent prohibited-transaction concerns.

III. General Account Stable Value: A Prohibited Transaction by Design

General Account stable value products invert every one of those principles.

A. Single-entity credit risk

A GA stable value fund is simply a fixed annuity backed by the insurer’s general account. Participants bear:

- Insurer credit risk

- Downgrade risk

- Liquidity restrictions

- Contract-value limitations

There is no diversification at the insurer level.

B. Discretionary, proprietary crediting rates

As shown in multiple audited disclosures (including recent Great Gray CIT filings https://greatgray.com/wp-content/uploads/2025/05/0.08-Stable-Value-Funds-2024-Final.pdf), insurers admit that:

- Crediting rates are reset periodically

- Rate setting is “discretionary and proprietary”

- Decisions reflect internal profit targets, expenses, and capital management

That is not investment management. That is spread extraction.

C. ERISA prohibited-transaction implications

When a plan fiduciary selects a GA product:

- The insurer is a party in interest

- The insurer sets participant returns for its own account

- The plan is locked into a conflicted bilateral contract

This squarely implicates ERISA §406(a) and §406(b):

- Transfer of plan assets to a party in interest

- Fiduciary causing plan to engage in transaction benefiting a service provider

- Self-dealing through spread profits

No exemption cures the structural conflict.

IV. Separate Accounts: “Synthetic-Like” in Marketing, GA-Like in Reality

Separate Account (SA) stable value products are often marketed as a safer alternative to GA products. That claim does not withstand scrutiny.

A. Illusory separation

While assets may be legally segregated, economic control remains with the insurer:

- Investment guidelines are often loose or discretionary

- Insurer retains rate-setting authority

- Participant returns remain subject to insurer spread decisions

B. Weak or non-binding guidelines

Unlike synthetic portfolios:

- SA guidelines frequently allow broader credit exposure

- Enforcement mechanisms are weak

- Insurers can “reinterpret” constraints during stress

C. Crediting rate discretion remains

Separate accounts still allow insurers to:

- Smooth returns to protect insurer margins

- Delay or suppress rate increases

- Internalize gains while socializing losses

As you’ve documented in The Great Annuity Mirage, separate accounts pretend to be synthetic while retaining the core conflicts of general account products. https://commonsense401kproject.com/2025/07/28/the-great-annuity-mirage-how-separate-accounts-continue-to-mislead/

From an ERISA perspective, SA products remain conflicted insurance arrangements, not arm’s-length investment products.

V. The Efficient Frontier Confirms the Legal Analysis

Your Stable Value Efficient Frontier work shows what theory predicts:

- Synthetic stable value delivers higher risk-adjusted returns

- GA and SA products underperform after adjusting for credit risk

- The “stability” premium is purchased with hidden tail risk

In other words, GA and SA products are not just legally problematic — they are economically inferior.

That makes their selection even harder to defend under ERISA’s prudence standard.

VI. Why This Matters for Litigation and Fiduciary Oversight

The takeaway is simple:

- Synthetic stable value

- Diversified

- Transparent

- Formula-driven

- Consistent with ERISA duties

- General Account stable value

- Single-entity credit risk

- Discretionary insurer pricing

- Embedded self-dealing

- Inherently conflicted

- Separate Account stable value

- Cosmetic separation

- Weak constraints

- Same economic conflicts

Courts have increasingly recognized that process matters. When fiduciaries choose GA or SA products over available synthetic alternatives, they are not just choosing a different implementation — they are choosing a conflicted structure.

That is why GA and SA stable value products should be analyzed not merely as “imprudent,” but as ERISA prohibited transactions.

VII. Conclusion: Stable Value Done Right — and Done Wrong

Stable value itself is not the problem.

Insurance-based stable value is the problem.

Diversified synthetic stable value shows that it is entirely possible to deliver capital preservation, liquidity, and reasonable returns without exposing participants to insurer balance-sheet risk or conflicted rate-setting.

When fiduciaries instead choose GA or SA products, they are choosing opacity, concentration, and conflicted compensation — the very conditions ERISA was designed to prevent.

—————————————-

Why General Account (GA) and Separate Account (SA) Are ERISA Prohibited Transactions — and Diversified Synthetic Is Not

| Feature | General Account (GA) Stable Value | Separate Account (SA) Stable Value | Diversified Synthetic Stable Value |

| Underlying structure | Fixed annuity backed by insurer’s entire general account | Insurer-managed separate account marketed as “bond-like” | Diversified bond portfolio + third-party wrap contracts |

| Primary risk bearer | Plan participants (single insurer credit risk) | Plan participants (still insurer-controlled) | Participants bear diversified bond risk; wrap providers guarantee liquidity |

| Credit risk profile | Single-entity, undiversified insurer balance-sheet risk | Still insurer credit risk; separation is largely cosmetic | Diversified across multiple wrap providers and issuers |

| Academic risk comparison | ~10× the credit risk of diversified synthetic (Fabozzi Handbook) | Higher than synthetic; lower than GA only in marketing | Lowest structural credit risk |

| Investment guidelines | None applicable to participants; insurer invests freely | Often loose, discretionary, insurer-controlled | Strict, enforceable guidelines (duration, credit, sectors) |

| Guideline enforcement | Internal insurer discretion | Insurer discretion; weak enforcement | Contractual, third-party enforceable |

| Crediting rate determination | Discretionary and proprietary insurer decision | Insurer-set, discretionary, smoothed | Formula-driven, transparent, observable inputs |

| Crediting rate transparency | Opaque; internal pricing committees | Opaque; insurer methodology | High transparency; auditable formulas |

| Spread extraction | Explicit spread product (insurer profits from rate suppression) | Spread product remains | No embedded spread |

| Liquidity / exit risk | Contract-value limits; MVAs possible | Similar termination risk | Liquidity guaranteed by wraps, subject to formula |

| Diversification | None (single insurer) | Limited / illusory | True diversification |

| Party-in-interest status | Insurer is a party in interest | Insurer is a party in interest | Wrap providers are arms-length counterparties |

| ERISA §406(b) self-dealing risk | High – insurer sets returns for its own account | High – insurer controls rate setting | Low – no discretionary self-pricing |

| ERISA §404 prudence alignment | Weak (opaque, concentrated risk) | Weak (misleading structure) | Strong (process-driven, diversified) |

| Regulatory oversight | State insurance regulators | State insurance regulators | Plan fiduciaries + contractual oversight |

| Typical marketing narrative | “Guaranteed,” “safe,” “principal protected” | “Synthetic-like,” “separate,” “safer GA” | “Institutional,” “transparent,” “bond-based” |

| Economic reality | Insurance balance-sheet exposure | Insurance balance-sheet exposure with cosmetic separation | Bond portfolio + diversified liquidity protection |

| ERISA litigation posture | Inherently conflicted; prohibited transaction | Conflicted; prohibited transaction | Defensible investment structure |

General Account and Separate Account stable value products embed insurer self-dealing, discretionary pricing, and single-entity credit risk, making them structurally incompatible with ERISA’s duties of loyalty and prohibited-transaction rules — while diversified synthetic stable value does not.

Journal of Economic Issues Thomas E. Lambert University of Louisville, Christopher B. Tobe , ““Safe” Annuity Retirement Products and a Possible U.S. Retirement Crisis,” https://ir.library.louisville.edu/faculty/943/

https://commonsense401kproject.com/2025/10/30/the-stable-value-efficient-frontier/

Appendix: Documented Historical Risks of Insurance-Based Stable Value Products (1992–2009 and Beyond)

Why General Account and Separate Account Stable Value Products Fail Core Fiduciary Principles

This Appendix documents that the risks inherent in insurance-based stable value products—particularly general account and separate account contracts—are not theoretical, not novel, and not unforeseeable. These risks have been repeatedly identified by Federal Reserve economists, acknowledged by senior Federal Reserve officials during the Global Financial Crisis, and formally recognized by federal regulators through systemic-risk designations of major life insurers.

By contrast, diversified synthetic stable value structures were specifically designed to eliminate or mitigate these known risks through issuer diversification, transparent valuation, and contractual protections absent from insurance-based products.

I. The Federal Reserve (1992): SPDAs and GICs Are Not “Like Money in the Bank”

In its 1992 Quarterly Review, the Federal Reserve Bank of Minneapolis directly examined Single Premium Deferred Annuities (SPDAs) and Guaranteed Investment Contracts (GICs)—the functional predecessors of modern general-account stable value products—and rejected the industry narrative that such products were “safe” or bank-like

Federal Reserve economists Richard M. Todd and Neil Wallace concluded that SPDAs and GICs were credit instruments, not insured deposits, and that purchasers were effectively making unsecured loans to insurance companies, with repayment dependent on the insurer’s overall financial condition rather than on segregated assets or transparent investment strategies

Key findings include:

- Policyholders lack visibility into how insurers invest their funds;

- Claims are general creditor claims, not ownership interests;

- Insurers retain full discretion over asset allocation within broad regulatory limits;

- Rating agencies and state regulators repeatedly failed to detect mounting risk prior to insurer collapses (e.g., Executive Life).

The Federal Reserve explicitly warned that implicit and explicit guarantees create moral hazard, allowing insurers to attract large volumes of “docile capital” while taking risks that policyholders neither understand nor approve https://www.minneapolisfed.org/research/quarterly-review/spdas-and-gics-like-money-in-the-bank

This analysis directly undermines the premise that general-account stable value products can satisfy ERISA’s prudence and diversification requirements.

II. Defined-Contribution Plans Were a Primary Vector for GIC Risk

The Federal Reserve further documented that defined-contribution pension plans, including 401(k) plans, were a primary driver of GIC growth, precisely because plan fiduciaries sought “simple” fixed-rate options for participants

Critically, the Fed noted that GICs were unallocated contracts, meaning:

- The insurance company’s liability was not tied to specific assets;

- Participants had no contractual claim to any segregated portfolio;

- In insolvency, plans competed with other general creditors.

These characteristics are identical to those of modern general account stable value contracts offered in 401(k) plans today.

III. 2008–2009: Bernanke Confirms the Failure of “Guarantees”

During the Global Financial Crisis, Federal Reserve Chairman Ben Bernanke publicly confirmed that the supposed protections embedded in insurance-based stable value products failed precisely when needed most.

In 2009 testimony, Bernanke stated:

“Workers whose 401(k) plans had purchased $40 billion of insurance from AIG against the risk that their stable value funds would decline in value would have seen that insurance disappear.”

This admission establishes three critical facts:

- Stable value contracts are only as strong as the insurer providing them;

- Counterparty failure risk is real and systemic, not remote;

- Participants bear uncompensated risk when insurers falter.

The collapse of AIG’s Financial Products division exposed the fragility of insurance guarantees during periods of market stress—exactly when stable value is marketed as a “safe harbor.”

IV. Prudential’s Systemic Risk Designation Confirms Single-Entity Exposure

Federal regulators formally recognized these risks when the Financial Stability Oversight Council (FSOC) designated Prudential Financial as a systemically important financial institution (SIFI).

The FSOC’s determination emphasized that:

- Prudential’s general account liabilities are subject to discretionary withdrawal;

- A loss of confidence could trigger asset fire sales;

- Pension plans have large exposures to Prudential through stable value and annuity products;

- Distress at Prudential could impair retirement plans’ ability to meet obligations

SIFI Report Prudential Financia…

This designation directly contradicts any claim that general-account stable value products present minimal or immaterial risk to plan participants.

V. Credit Default Swaps and Market-Based Evidence of Insurer Risk

Market-based measures further confirm that insurer risk is priced, observable, and variable over time. As documented in prior analysis, credit default swap (CDS) spreads for major life insurers fluctuate materially with market conditions, reflecting investors’ assessment of default and downgrade risk.

Plan participants in insurance-based stable value products are not compensated for bearing this credit risk, nor are they provided with tools—such as downgrade triggers or exit rights—to mitigate it.

VI. Offshore Private Credit and Regulatory Arbitrage

Recent evidence from the Bank for International Settlements (BIS) demonstrates that insurers increasingly use offshore reinsurance and private credit structures to enhance yield while obscuring risk. These structures:

- Reduce transparency;

- Complicate resolution in stress scenarios;

- Increase reliance on regulatory arbitrage rather than economic substance.

Such practices further erode any claim that insurance-based stable value products align with ERISA’s fiduciary standards of prudence, loyalty, and diversification.

VII. Why Diversified Synthetic Stable Value Is Different

Unlike general-account or separate-account insurance products, diversified synthetic stable value:

- Separates custody, investment management, and wrap providers;

- Diversifies credit exposure across multiple, independent counterparties;

- Uses transparent, market-based valuation of underlying assets;

- Incorporates downgrade provisions and replacement rights.

These features were developed in direct response to the historical failures documented above.

Conclusion

Federal Reserve research as early as 1992, senior Federal Reserve testimony during the Global Financial Crisis, and formal systemic-risk determinations all confirm that insurance-based stable value products embed concentrated, opaque, and uncompensated credit risk.

Because these risks are known, documented, and avoidable, their continued use in ERISA-governed defined-contribution plans—when superior diversified alternatives exist—supports the conclusion that general-account and separate-account stable value products are structurally imprudent and prohibited transactions, while diversified synthetic stable value is not.

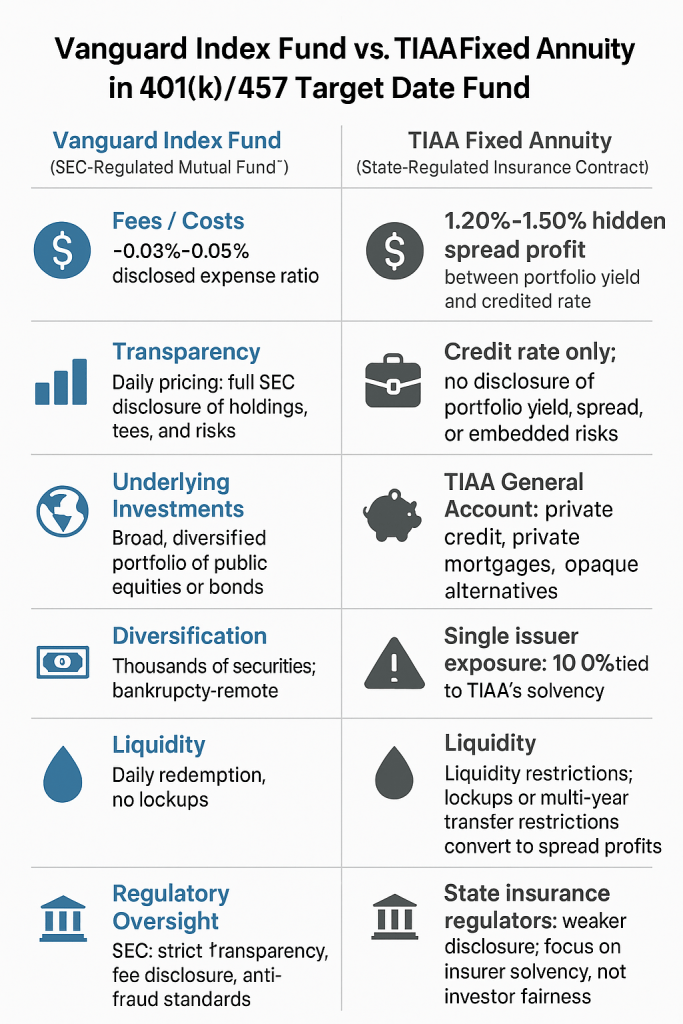

CASE STUDY Vanguard Synthetic vs. TIAA General Account from

Journal of Economic Issues Thomas E. Lambert University of Louisville, Christopher B. Tobe , ““Safe” Annuity Retirement Products and a Possible U.S. Retirement Crisis,” https://ir.library.louisville.edu/faculty/943/

TIAA has at least 10 times the risk, 10 times the fees.

Comparing the most conservative and most highly rated fixed annuity, TIAA, to the Vanguard RST portfolio tells a story of two very different products. Vanguard holds 74% in high-quality (AA & above) rated securities, while TIAA only holds 12.5% in rated securities. While the Vanguard is nearly 96% liquid in public securities, the TIAA portfolio is only 48%, which is typical. T

Table 1—Investment Portfolios

| TIAA | Vanguard Trust SV | |

| Public Securities | 48.0% | 96.7% |

| Gov AAA | 7.8% | 63.8% |

| AA | 4.7% | 10.1% |

| A | 14.0% | 21.5% |

| BBB | 16.6% | 0.0% |

| Below Investment Grade | 3.7% | |

| Non-rated Public Securities | 1.2% | 4.6% |

| Other AA GICS | 3.3% | |

| Private Fixed Income | 22.0% | 0.0% |

| Private Mortgages | 13.3% | 0.0% |

| Real Estate | 4.5% | 0.0% |

| Other Non-Securities | 9.6% | 0.0% |

| Natural Resources | 2.9% | 0.0% |

Sources: https://www.tiaa.org/public/pdf/performance/retirement/profiles/TIAA_Gen_Act_Fin_Strength.pdf

Pingback: Fixed Annuities Have Comparables. They Do Not Have Benchmarks. | The CommonSense 401k Project