Without them, plans are locked into a death spiral toward default. With them, annuities can actually work within a responsible fiduciary framework. By Chris Tobe, CFA

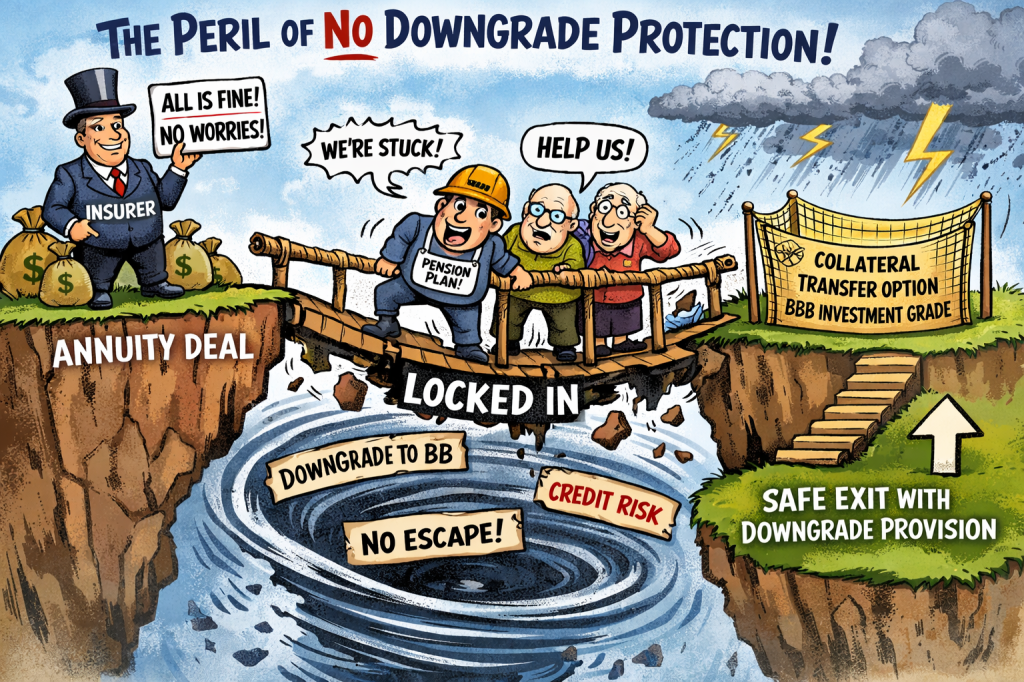

All annuities in plans, fixed annuities, and lifetime income annuities in DC plans need downgrade provisions. However, the largest immediate use is the Pension Risk Transfer (PRT) annuities, which allow defined benefit plans to offload longevity risk. But there’s a hidden structural flaw in most annuity contracts: no downgrade protection. In plain English, that means a plan can pay millions or billions to an insurer and then be held hostage if the insurer’s credit deteriorates.

This is not a hypothetical risk. Recent litigation and real-world defaults show that without contractual protections tied to credit quality, plans are effectively locked into a downward spiral that can lead to underfunding, distress, or worse — a default without protection from any agency like the PBGC.

What’s a Downgrade Provision — and Why It Matters

A downgrade provision is a contractual term that triggers plan protections if the insurer’s credit rating slips below agreed thresholds. These protections can include:

- Mandatory collateral posting

- Escrow or trust funding for future liabilities

- Termination or transfer rights

- Step-up pricing or premium refunds

In other words: if the insurer’s credit weakens, the plan gains leverage and protection.

Without downgrade protections, plans have no recourse until the insurer fails outright.

Why Current Annuities Trap Plans in a Death Spiral

Most PRT contracts do not include meaningful downgrade provisions. Plans that sign these deals typically:

- Pay upfront premiums that are irrevocable

- Give up the assets and liability control

- Lose leverage if the insurer’s credit deteriorates

- Are left with nothing but hope that the insurer stays solvent

This creates a lock-in effect:

- The plan can’t go back to the market

- It can’t demand collateral

- It can’t shift to a stronger carrier

- It can’t adjust to changing market conditions

If the insurer is later downgraded — from A to BBB, or BBB to BB — the plan has zero contractual rights to protect its interests. The result? A death spiral where liabilities are fixed but the counterparty becomes riskier and less reliable.

PRT’s Best Annuity Would Have Downgrade Provisions

DOL with PRT’s calls for the best available annuity. The best possible annuity for a plan isn’t necessarily the lowest-priced one. It’s the one that:

- Complies with the plan’s Investment Policy Statement

- Aligns with fiduciary duty and credit quality guidelines

- Includes meaningful downgrade triggers

- Protects the plan throughout the contract’s life

For example, an annuity that commits to posting collateral if the carrier drops below BBB investment grade, or that returns unamortized premium if the insurer is downgraded to BB, gives the plan real protections. Yes — these annuities would likely:

- Cost more upfront

- Require higher capital from carriers

- Be less profitable for insurers

And that’s exactly why carriers don’t offer them.

If They’re Safe, Why Not Offer Downgrade Provisions?

Here’s the point that should make every fiduciary sit up:

If including downgrade protections truly made annuities safe, transparent, and better aligned with risk — insurers would offer them freely. The fact that they don’t tells you something important about incentive misalignment.

The most basic rules of fiduciary management — requiring collateral when credit risk increases, monitoring counterparty risk, aligning investments with the plan’s Investment Policy Statement — are absent in most annuity contracts. That’s not a bug. It’s a business model choice by carriers.

Downgrade Provisions Are Consistent with a Responsible IPS

Plan fiduciaries are required to follow the plan’s Investment Policy Statement (IPS). An IPS typically includes:

- Credit quality guidelines

- Counterparty exposure limits

- Risk-adjusted return expectations

- Ongoing monitoring processes

However, ERISA does not explicitly require an IPS so plans with annuities typically do not have one or a weak IPS.

Annuities with downgrade provisions are the only ones that can be squared with a prudent IPS. Without them, an annuity contract:

- Ignores credit quality thresholds

- Ignores counterparty risk management

- Treats the insurer like a riskless utility

- Places the plan in a contractual black hole

Downgrade provisions aren’t exotic. They are the mechanism that forces the contract to behave like an investment — not a one-way bet on the carrier.

See: Investment Policy Statements & Fiduciary Duty — why IPS should govern annuity contracts.

https://commonsense401kproject.com/2023/03/12/investment-policy-statements-crucial-to-fiduciary-duty/

Why Courts and Fiduciaries Miss This Danger

Despite defaults and downgrades in the marketplace, courts have repeatedly overlooked the structural risk in annuity contracts. As we explained previously:

PRTs: Why courts keep ignoring the dangers of pension risk transfer annuities — and why these cases must be appealed.

https://commonsense401kproject.com/2025/11/06/prts-why-courts-keep-ignoring-the-dangers-of-pension-risk-transfer-annuities-and-why-these-cases-must-be-appealed/

Two core mistakes courts make:

- Treating insurers as effectively riskless

- Ignoring that annuity contract terms — not actuarial models — determine real protections

The fact that there is a Credit Default Swap market on insurers and the premiums required prove that insurers are not riskless https://commonsense401kproject.com/2025/10/29/annuity-risk-measured-by-credit-default-swaps-cds/

Plans Should Insist on Downgrade Provisions — or Walk Away

A commonsense fiduciary framework for annuity purchases should include:

✅ Mandatory downgrade triggers tied to specified rating thresholds

✅ Contractual collateral or security requirements

✅ Termination/transfer rights on downgrade

✅ Alignment with plan IPS and credit risk guidelines

✅ Ongoing monitoring and enforcement mechanisms

If insurers won’t offer these terms, plans should ask:

“Why are you unwilling to protect the plan’s retirees? If this product is truly safe, why not put your money where your mouth is?”

Conclusion

Annuities without downgrade provisions aren’t “safe” — they’re traps that embed counterparty risk without recourse.

Plans that insist on downgrade protections:

- Align with basic fiduciary duty

- Respect IPS credit and counterparty guidelines

- Protect assets and liabilities over time

- Avoid the death spiral into default

Plans that accept standard, non-protective annuity contracts:

- Give up leverage

- Ignore credit risk

- Lock themselves into potential catastrophe

- And leave retirees exposed

Plans should not buy an annuity without robust downgrade provisions. If carriers won’t offer them — that’s the plan’s answer.